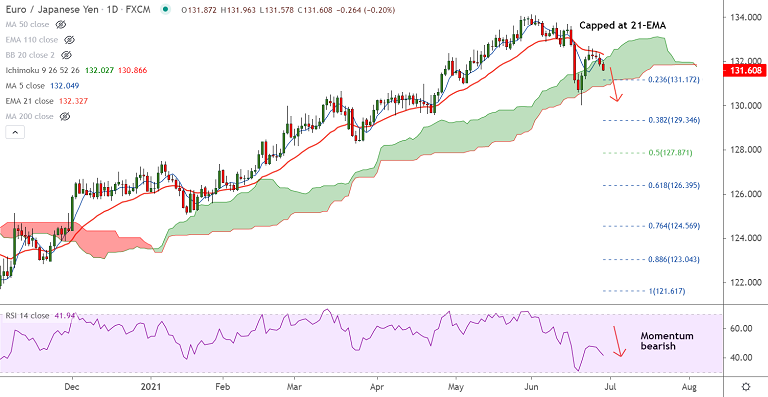

EUR/JPY chart - Trading View

EUR/JPY was trading 0.12% lower on the day at 131.71 at around 05:10 GMT, outlook bearish.

The pair is extending weakness for the 4th straight session, upside was rejected at 21-EMA.

Price action has slipped below 5-DMA, plunges deeper into the daily cloud. Break below cloud will plummet prices further.

Cautious sentiment prevails ahead of the key German inflation data and speech from ECB President Christine Lagarde.

Further, looming uncertainty over the Brexit talks and Germany’s push to ban British travelers add downside pressure on the quote.

Technical bias is also bearish. Momentum is with the bears. High volatility is likely to drag prices lower.

Major Support Levels:

S1: 131.17 (23.6% Fib)

S2: 130.86 (Cloud base)

S3: 130.50 (110-EMA)

Major Resistance Levels:

R1: 131.89 (55-EMA)

R2: 132.33 (21-EMA)

R3: 132.58 (20-DMA)

Summary: EUR/JPY was trading with a bearish bias. Scope for downside rises as pair plunges further into daily cloud. Break below daily cloud will accelerate weakness.