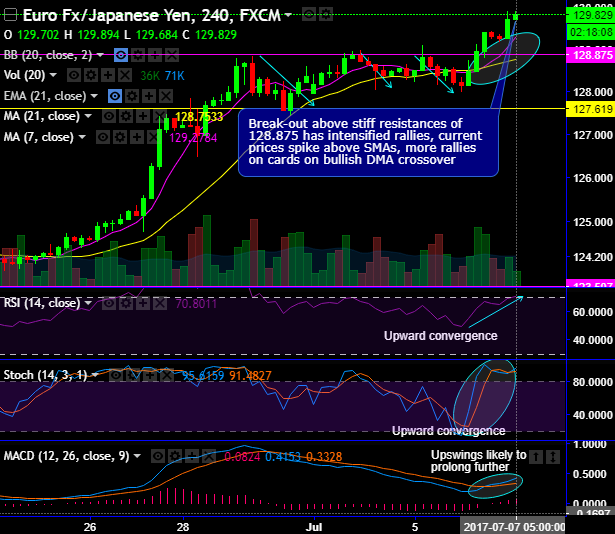

It has broken a stiff resistance of 128.875 levels, current prices spike well above SMAs.

For now, more rallies on card as 7DMA crosses over 21DMA which is a bullish crossover.

After last week’s whipsaws pattern, bulls have gone above DMAs again (4H chart).

On a broader perspective, bull swings seem to be gaining traction above 50% Fibonacci levels, as a result, rallies are heading towards one and a half month highs in consolidation phase with bullish EMA crossover.

Please be noted that the intensified bullish momentum from leading oscillators signal buying interests on both timeframes.

The major trend has again resumed bullish swings in this consolidation phase after breaching handle pattern adjoined to inverse saucer (refer monthly charts), while this consolidation phase has been observed from last one year or so.

Both leading oscillators signal buying interests, RSI has been converging upwards even above 70 levels, stochastic curves have still been %k crossover even in overbought territory and signals intensified buying momentum, the same has been the signal on monthly term without any indecisiveness.

To substantiate this, the current MACD curves are still in bearish trajectory on monthly terms and in bullish trajectory on daily terms with bullish crossover on both timeframes that signal rising prices to prolong further.

Trading tips:

Contemplating above technical reasoning, for intraday trading perspective, it is advisable to buy one touch binary calls on dips for targets upto 125.7962. The speculators are likely to add magnifying effects to their yields as long as spot FX keeps spiking higher on expiration.

Currency Strength Index: FxWirePro's hourly EUR spot index has turned into 88 (which is extremely bullish), while hourly JPY spot index was at -119 (very bearish) at 06:58 GMT. For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand