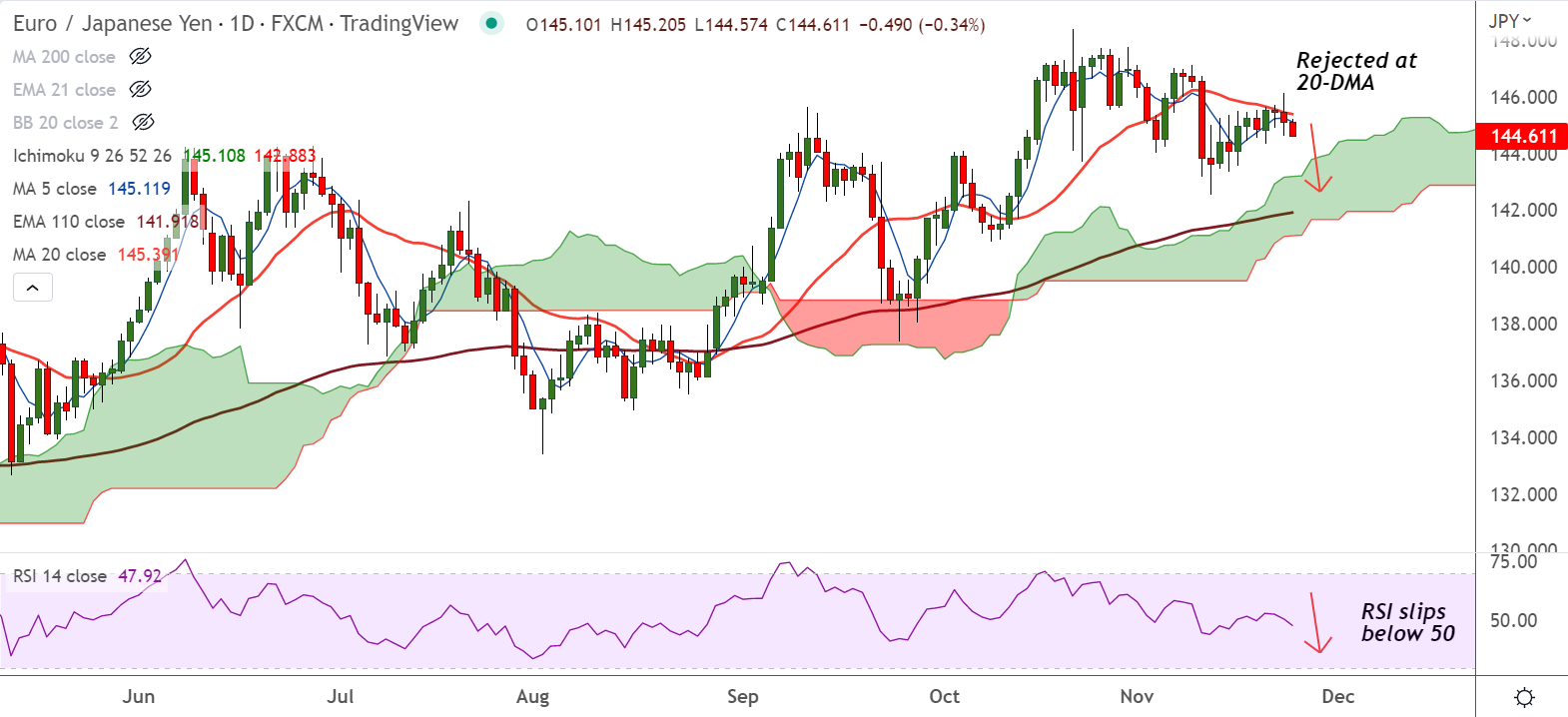

Chart - Courtesy Trading View

EUR/JPY was trading 0.41% lower on the day at 144.52 at around 09:05 GMT.

The pair is extending weakness after upside was rejected at 20-DMA, outlook has turned bearish.

The euro has been under pressure after European Central Bank (ECB) Vice President Luis de Guindos projected negative growth rates for the fourth quarter.

Guindos added that “Upcoming inflation data projections will still be high before starting to slow down in the first quarter of 2023”.

On the otherside, low inflation is still a major concern for Japan. Prime Minster Fumio Kishida has announced a $200 billion stimulus package recently to combat deflation.

Price action has slipped below 200H MA, technical indicators suggest further downside. The pair is on track to test 55-EMA at 143.90.