Just a quick glance through geopolitics: The euro seemed under extreme pressure yesterday owing to the renewed Italexit threats that were triggered by known Eurosceptic and top Italian lawmaker Claudio Borghi saying that Italy having its own currency would solve its debt issues. However, the sharp market reaction is now observed, not only Borghi has by now back-pedalled by assuring the market that the government had no plans of leaving the euro zone but also the government is said to be caving in to the EU’s demands to lower its deficit targets. Now, as always, the devil is in the details. The euro’s recovery will only continue if the new fiscal plans are also feasible.

OTC Outlook and FX Options Analytics (EURJPY):

While Euro vol is more sensitive to the ebb and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions. Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks.

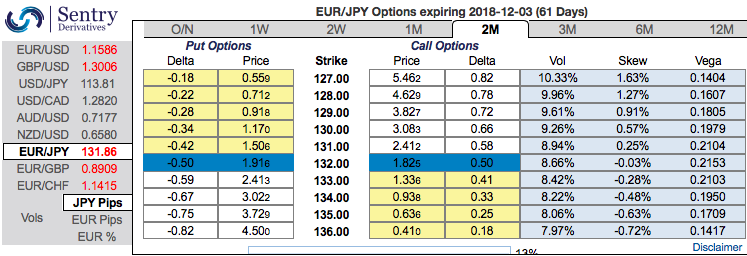

Hedging skewness: Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 127 levels so that OTM instruments would expire in-the-money.

Risk reversals: Most importantly, to substantiate the above indications, negative risk reversal numbers of all euro crosses except EURGBP (especially EURJPY) across all tenors are also substantiating bearish risks in the long run amid minor abrupt upswings in the short-term. IVs for 2w tenors are on lower side which is interpreted as conducive for put option writers, and 2m IVs are on higher side which is good for the put holders.

Overall OTC barometer: OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The Market Pin Risk report shows large options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, EURJPY has the highest interest towards forward point at 128.90). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

While the OTC volume index exhibits volume traded in the last 24-hours versus a rolling one month daily average, and euro options are buzzing on above-stated news flows (especially, EURJPY contracts to trade 2ndhighest volumes). Without capturing all OTC flow, the index is a barometer of volume on liquid contracts for different crosses. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

Options Trade Tips (EURJPY):

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders. Source: sentrix, saxobank

Currency Strength Index:FxWirePro's hourly EUR spot index is flashing at -6 levels (which is neutral), while hourly JPY spot index was at 2 (neutral) while articulating at (08:02 GMT). For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One