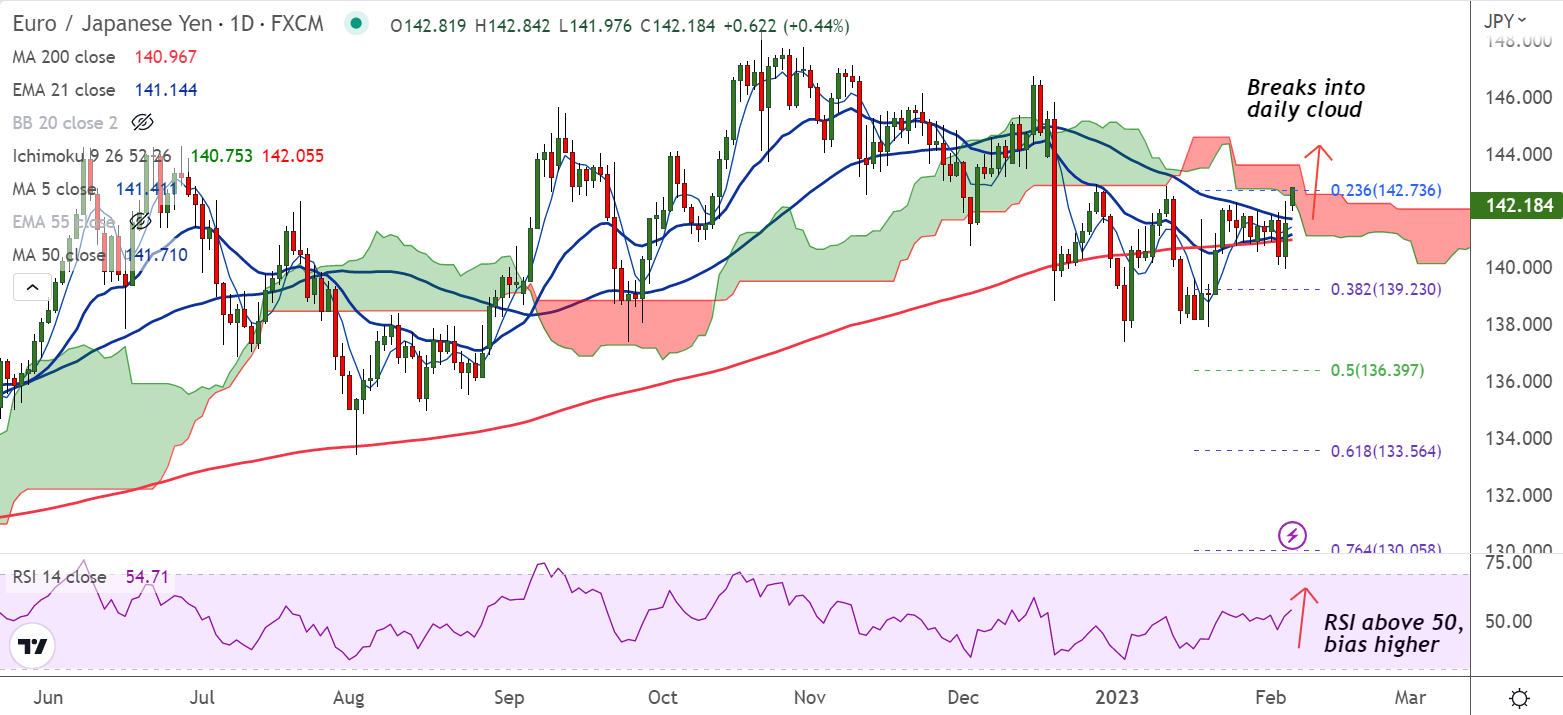

Chart - Courtesy Trading View

The Japanese Yen has opened the week on a dovish note, plummets against crosses across the board.

EUR/JPY opened with a bullish gap open and is trading 0.45% higher on the day at 142.19 at around 05:30 GMT.

News that Prime Minister Fumio Kishida's administration was in the final stages of deciding on current governor Haruhiko Kuroda's successor along with two new deputy governors adds pressure on the Japanese yen.

Amamiya, a strong potential, has the most dovish policy credentials, raising uncertainty about BOJ's eventual exit from its ultra-easy monetary stance.

On the other side, after a bumper interest rate hike by the European Central Bank (ECB), markets expect the central bank to continue hiking rates as the road to 2% inflation is far from over.

Comments from ECB policy makers on Friday:

Peter Kazimir - "I don't think the March rate hike will be the last.”

Pierre Wunsch - "ECB won't go from a 50 basis points (bps) rate hike in March to a zero in May."

Wunsch added - "A 25 bps or a 50 bps hike is possible in May."

On the data front, the Eurozone Retail Sales data will remain in focus. Eurozone Retail Sales is expected to contract by 2.7% from a prior contraction of 2.8% on an annual basis.

Major Support Levels:

S1: 141.70 (50-DMA)

S2: 141.40 (5-DMA)

Major Resistance Levels:

R1: 142.76 (20-week MA)

R2: 143.34 (Upper BB)

Summary: EUR/JPY trades with a bullish bias. Close above 50-DMA will fuel further upside in the pair. Next major resistance lies at cloud top at 143.60.