EUR/JPY chart - Trading View

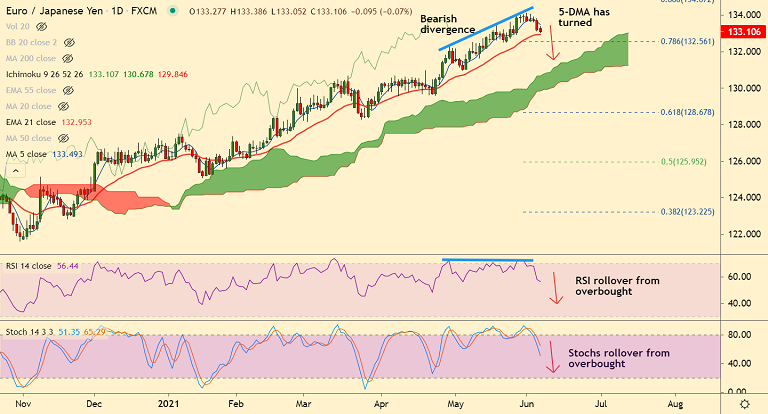

EUR/JPY was trading 0.08% lower on the day at 133.09 at around 08:10 GMT, after closing 0.39% lower in the previous session.

The pair trades with a bearish bias in the near-term. Price action is holding minor support at 21-EMA, break below will see further weakness.

Analysis of GMMA indicator shows major trend is bullish, but near-term bias has turned bearish.

Price action has slipped below 200H MA. 5-DMA has turned and bearish divergence on RSI on the daily charts keeps scope for further downside.

Focus now on the ECB meeting on Thursday. The central bank is expected to slow the current purchase in the PEPP from the current 80bn per month to some EUR 70bn per month in Q3.

The rate outlook is exoected to remain unchanged, focus shall be on new economic projections for cues on recovery.

21-EMA is immediate support at 132.95. Break below will see dip till lower Bollinger band at 131.94. Retrace above 200H MA negates any bearish bias.