Technically, the pair is bullish bias for the day but seems to have given up the momentum in recent gains at resistances of 113.343 on the intraday chart (4H), while the prices on monthly chart consistently rejected at inverse saucer to push further downside.

Please be noted that the prices have been slipping through lower Bollinger band where it has lost buying interest.

The leading indicators (RSI and stochastic) on this monthly graph suggest bearish trend continuation, while 7EMA crossing below 21EMA would also mean that bear trend continuation. These indications are factored in price behavior by sustaining or ready to evidence steep slumps despite bearish candle occurrences.

Option-trade recommendations:

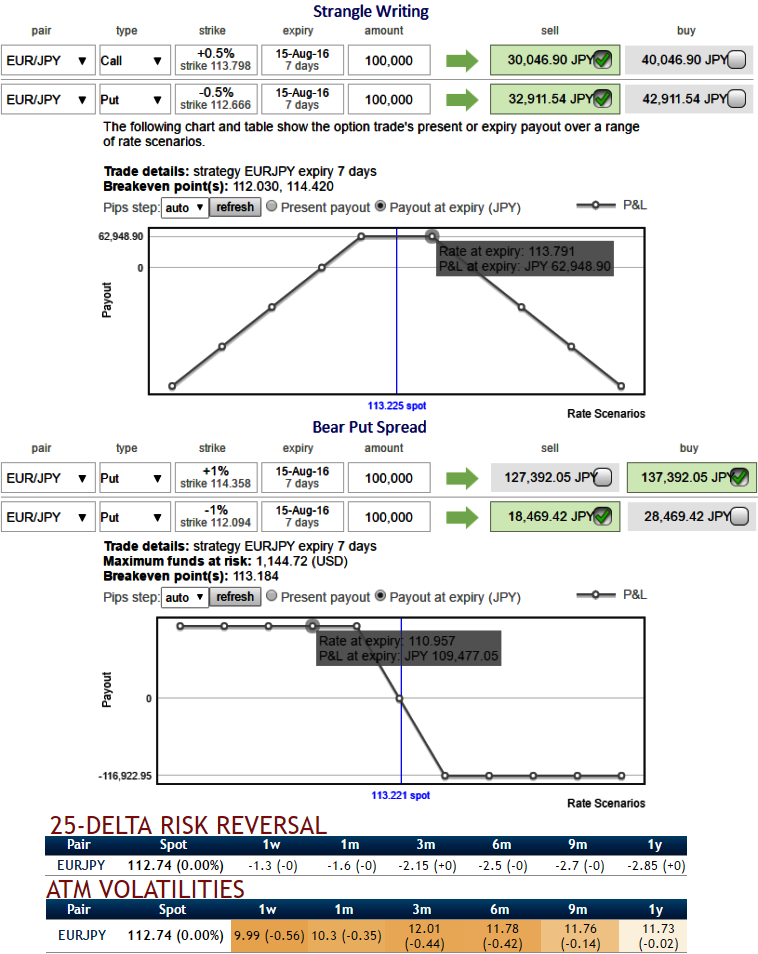

- Naked Strangle Shorts

For those whose foresee non-directional or no dramatic moves on either side and prefer to remain in a safe zone, we recommend shorting a straddle considering IV shrink.

Thereby, one can benefit from certain returns by shorting both calls and puts.

Thus, short 7D (1% OTM striking) put and (1% OTM striking) call simultaneously of the same expiry (preferably the short term for maturity is desired).

Maximum returns for the short straddle is achieved when the EUR/JPY price on expiry is trading at around 136.39 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

- Bear/Debit Put Spread (BPS):

As the risk appetite varies from different investors to different traders, we’ve customized our formulation of strategies for such varied circumstances.

On a hedging perspective, the foreign traders who are aggressively expecting slumps, debit put spreads are advocated as the selling indications are piling up on the monthly graph. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

The pay-off functions of both strategies are shown in the above diagram, please note the tenors in the diagram are just for demonstration purpose, use appropriate tenors suitable for your portfolios.