Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.53% lower on the day at 130.28 at around 11:55 GMT

Previous Week's High/ Low: 133.15/ 130.38

Previous Session's High/ Low: 132.61/ 130.38

Fundamental Overview:

Focus shifts to ECB President Christine Lagarde's speech later in the European session.

Any less hawkish tilt from Lagarde could add bearish pressure on the common currency.

Risk appetite improves after Ukraine requests a meeting with Russia, supporting the pair.

Technical Analysis:

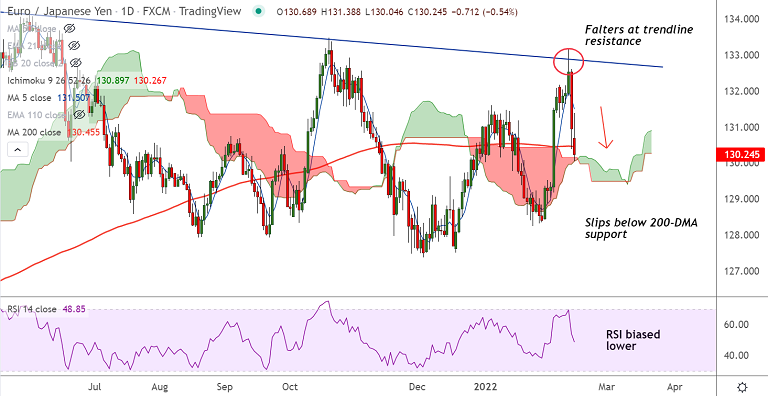

- EUR/JPY upside has been rejected at major trendline resistance

- The pair has slipped below 200-DMA support, raising scope for further downside

- Momentum has turned bearish on the daily charts. RSI is sharply lower and below the mark

- Stochs are on verge of bearish rollover from overbought levels

- Daily cloud offers strong support, but Chikou span is biased lower

Major Support and Resistance Levels:

Support - 130.06 (converged 20-DMA and cloud top), Resistance - 130.45 (200-DMA)

Summary: EUR/JPY trades with a bearish bias. Scope for further weakness. Next bear target 129.20.