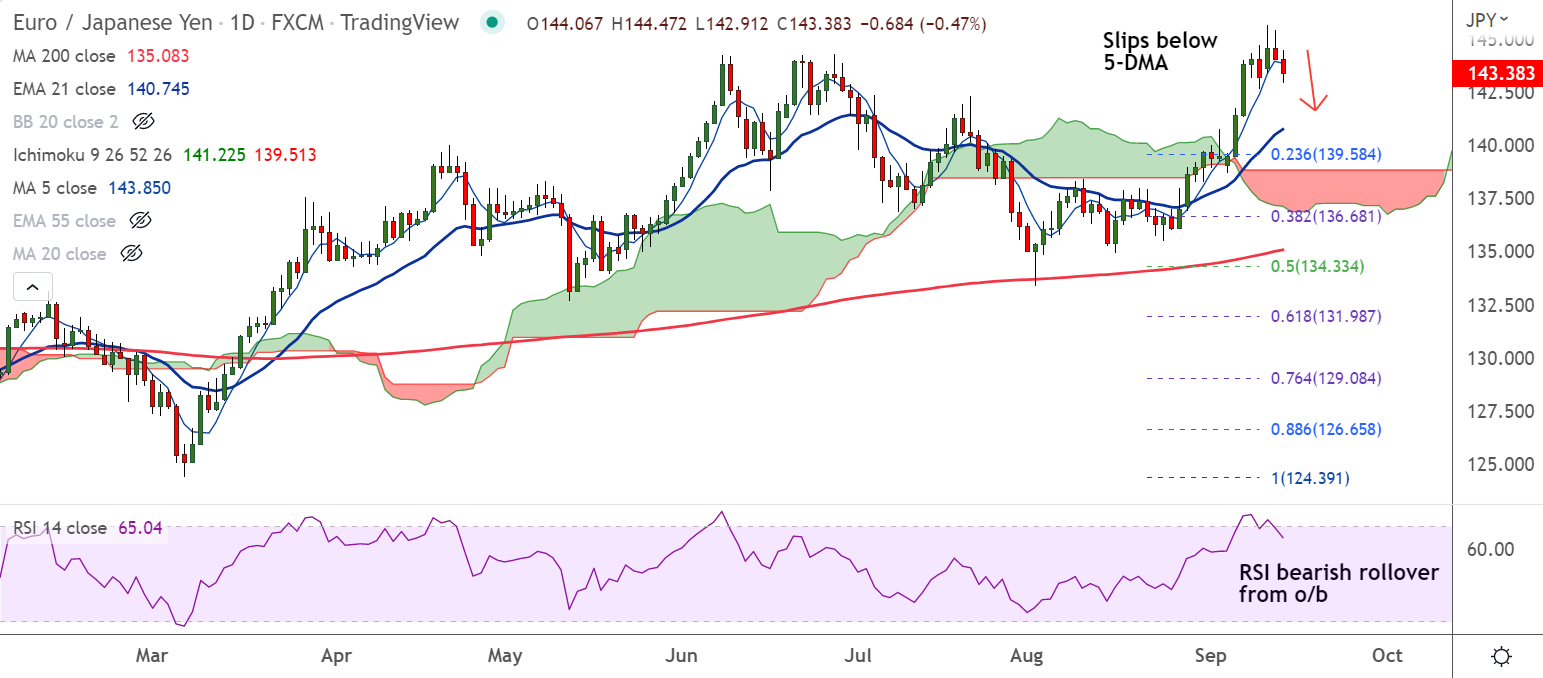

Chart - Courtesy Trading View

EUR/JPY was trading 0.50% lower on the day at 143.34 at around 10:50 GMT, extending previous session's weakness.

The Japanese Yen strengthens across the board amid jawboning by Japanese officials and rising speculations of the Bank of Japan (BoJ) intervention.

On the other side, recovery in the global risk sentiment as evidenced by a generally positive tone around the equity markets keeps downside in check.

Technical indicators are turning bearish. Chikou span is biased lower. RSI is on verge of bearish rollover from overbought levels.

The pair has slipped below 5-DMA and is hovering around 200H MA support.

Break below 200H MA will drag the pair lower. Next major support lies at 21-EMA at 140.74.