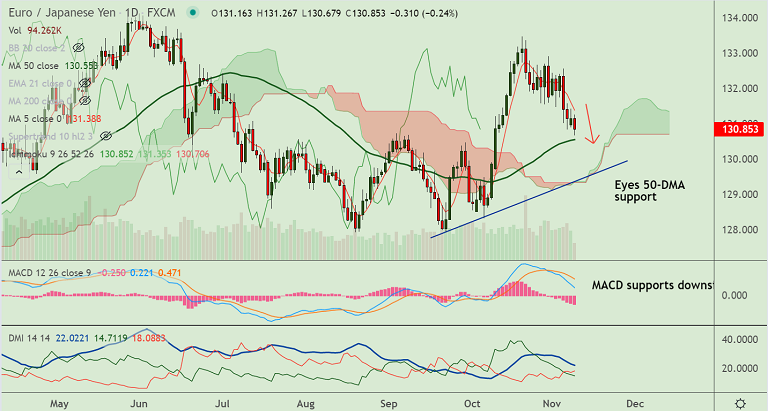

EUR/JPY chart - Trading View

EUR/JPY was trading 0.24% lower on the day at 130.85 at around 11:30 GMT, outlook remains bearish.

The German ZEW Economic Sentiment Index unexpectedly improved to 31.7 from 22.3 previous, beating estimates of 19.0 by a large margin.

However, the Current Conditions sub-index dropped to 12.5 in November as against 21.6 recorded in the previous month and 18.0 expected.

The Eurozone ZEW Economic Sentiment for November rose to 25.9 for the current month as compared to the 21.0 prior.

Upbeat German ZEW Economic Sentiment Index failed to impress euro bulls, EUR/JPY slips lower on the day amid widespread risk-off.

Support levels - 130.55 (50-DMA), 130.38 (200-DMA), 129.50 (Trendline)

Resistance levels - 131.38 (5-DMA), 131.49 (21-EMA), 132.04 (20-DMA)

Summary: The pair trades with a strong bearish bias. Bears eye 50-DMA support at 130.55 ahead of 200-DMA at 130.38. Break below 200-DMA will see further weakness.