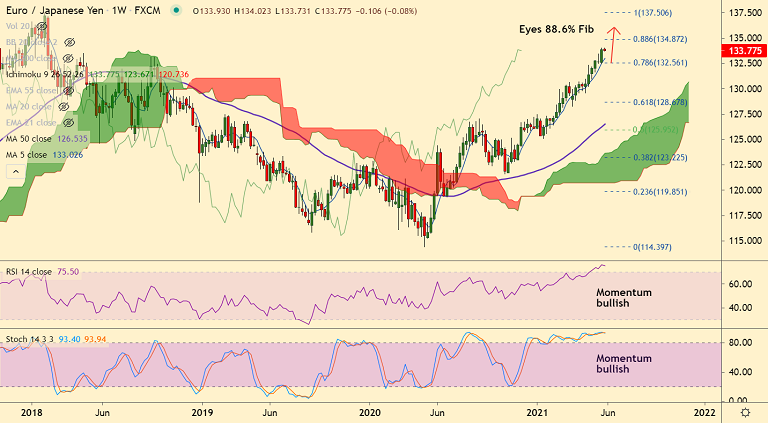

EUR/JPY chart - Trading View

EUR/JPY was trading 0.05% lower on the day at 133.81 at around 07:10 GMT.

The pair is extending range trade for the 2nd straight session, technical bias remains bullish.

Cautious sentiment ahead of Germany’s preliminary HICP inflation data for May keeps risk in check.

Germany’s Preliminary HICP for May keeps reflation fears on the table. HICP is expected to jump to 2.4% versus 2.1% prior, near the ECB target.

Technical indicators are bullish. GMMA indicator shows major and minor trend are strongly bullish.

Volatility is high as evidenced by wide Bollinger Bands. Momentum indicators are bullish.

EUR/JPY is facing some resistance at 134 handle. Overbought oscillators may cause minor pullbacks.

The pair is on track to close higher for the 7th straight month. Next bull target lies at 88.6% Fib at 134.87.