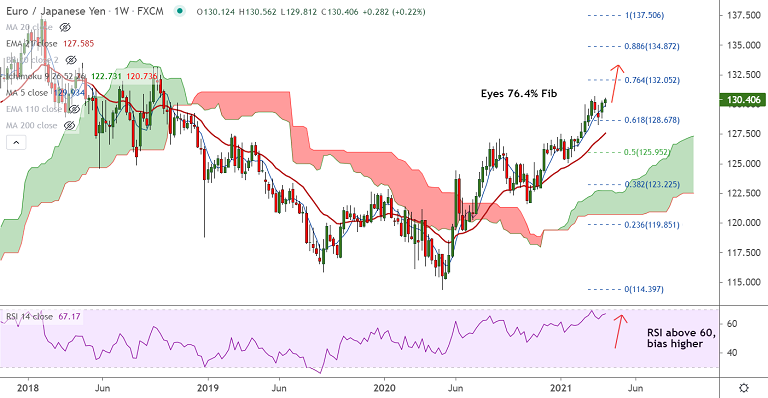

EUR/JPY chart - Trading View

Technical Analysis: Bias Bullish

- EUR/JPY is extending gains above 130 handle, outlook bullish

- Price action is above major moving averages, 5-DMA is biased higher

- GMMA indicator shows major and minor trend are strongly bullish

- Stochs and RSI show momentum is strongly bullish

- The pair trades above Ichimoku cloud and Chikou span is biased higher

- MACD and ADX also support upside in the pair

Support levels - 130.25 (5-DMA), 129.69 (20-DMA), 129.56 (21-EMA)

Resistance levels - 130.66 (Yearly high), 130.93 (Upper BB), 132.05 (76.4% Fib)

Summary: EUR/JPY trades with a bullish bias. The pair is attempting break above 200-month MA at 130.30 and is trading at 130.51 at around 09:50 GMT. Bullish momentum to carry the pair higher. Scope for test of 76.4% Fib at 132.05.