Chart - Courtesy Trading View

EUR/JPY was trading 0.29% higher on the day at 130.71 at around 11:35 GMT.

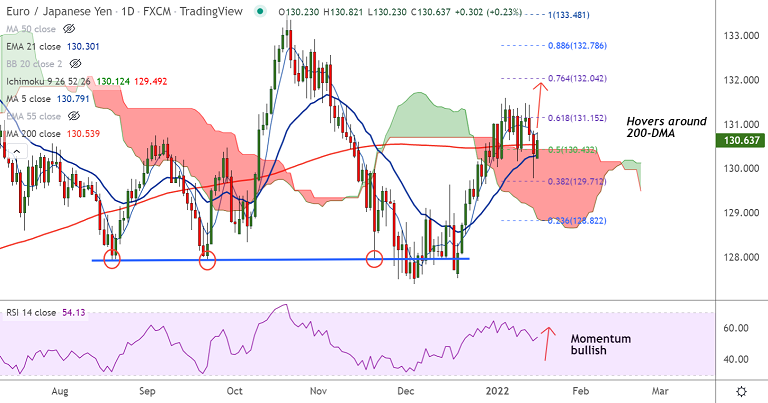

The pair has retraced dip below 200-DMA and daily cloud top, weakness only on break below,

ECB President Christine Lagarde reiterated the regional central bank’s readiness to keep the prices stable.

Virus numbers have eased from their record tops in the US, the UK and Europe, which in turn support risk sentiment.

German Bund yields will be eyed for clearer direction amid a lack of major data/events.

Technical bias is biased higher. Major moving averages are biased higher. Price action is trading shy of 200H MA, break above will fuel further gains.

5-DMA at 130.79 caps upside for now. Break above will see gains till 61.8% Fib at 131.15. Bullish invalidation below 200-DMA.