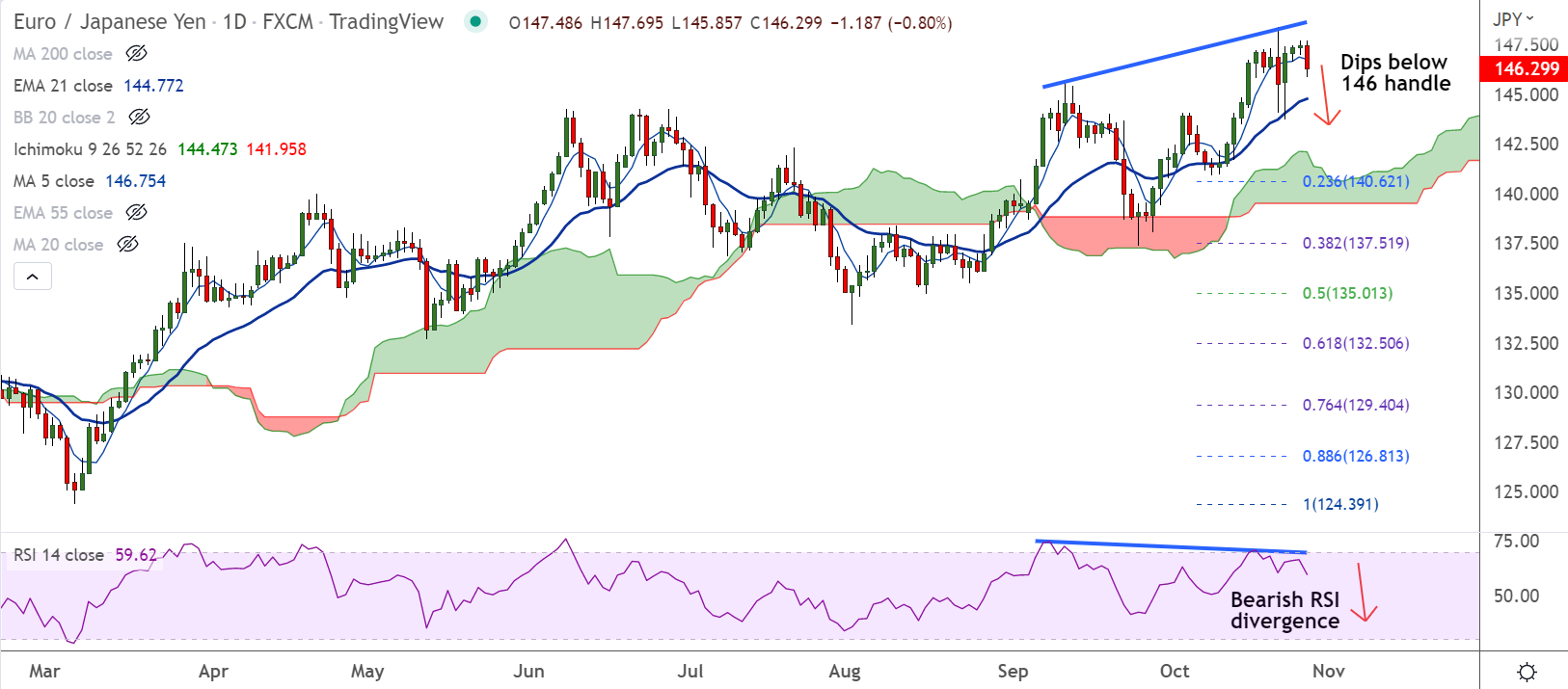

Chart - Courtesy Trading View

EUR/JPY was trading 0.79% lower on the day at 146.27 at around 14:40 GMT, bias lower.

The pair briefly dipped below 146 handle as euro comes under pressure post-ECB policy meet.

The European Central Bank (ECB) earlier on Thursday hiked key rates by 75 basis points in October as expected.

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 2%, 2.25% and 1.5% respectively.

Price action has slipped below 200H MA and technical bias for the pair is turning bearish on the intraday charts.

Chikou span is biased lower and bearish RSI divergence on the intraday charts has raised scope for further weakness.

The pair is trading below 5-DMA and is on track to test 21-EMA at 144.76. Major trend remains bullish, but break below 21-EMA will change near-term dynamics.