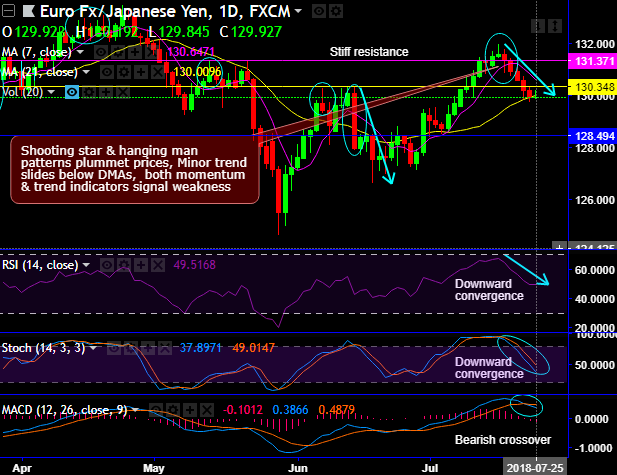

Chart and candlestick pattern formed – Shooting star and hanging man patterns occur at 131.612 and 131.348 levels (refer daily chart) that plummet prices, consequently, the minor trend slides below DMAs.

Both momentum and trend indicators signal weakness.

Failure swings were observed in the recent past at the stiff resistance of 131.371 levels, while the momentum and trend indicators also signal more weakness.

While on intermediate trend, hanging man patterns evidence slumps, slides below EMAs & trend edgy at 50% Fibonacci levels of 2014 December highs & 2016 June lows, both leading & lagging indicators signal weakness (refer monthly chart).

Trade tips: On trading perspective, at spot reference: 130.034 levels, it is advisable to initiate tunnel spreads, use upper strikes at 130.348 levels and lower strikes at 129.515 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping until expiry duration.

Ahead of the ECB meeting on Thursday, it is clear that not all ECB members are comfortable with its calendar-based guidance, and we would expect ECB rhetoric to evolve in a less dovish fashion assuming that the economy can get back on track, and stay there. Deploy shorts in futures contracts of mid-month tenors with a view to arresting potential dips.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -52 levels (which is bearish), while hourly JPY spot index was at -159 (bearish) while articulating at 06:43 GMT. For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?