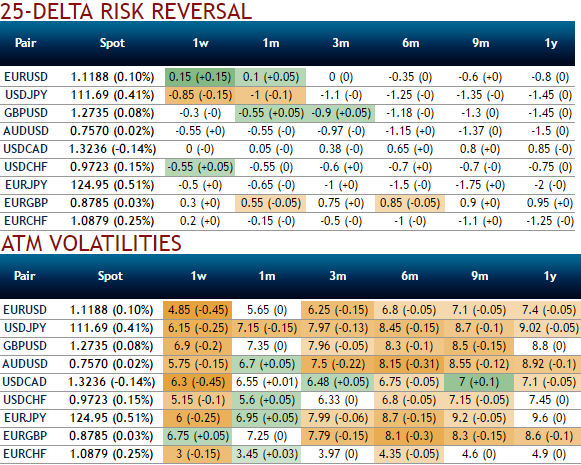

The hedgers’ interests of EURJPY have been explained by nutshell showing delta risk reversal, however, no new shift in sentiments is observed both in short and long run. As a result, we don’t see much traction OTM calls. The bearish-neutral but downside risks are indicated by these OTC tools.

Please also be observed that in EURJPY IV skews have been showing mounting hedging interests in OTM put strikes in 1-month tenors, while shrinking IVs of 1w tenors signifies option writers’ upper hand amid little upside traction.

In the recent times, EUR vols skews destabilized too much especially on post-French election results, while JPY volatility market normalized sharply. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the options market aggressively unwound smile positions.

Well, contemplating minor consolidation phase (short-term upswings) and the major downtrend, the foreign trader who has to carry long EURJPY exposures, a collar options trading strategy is advocated.

This could be constructed by holding the total number of units of the underlying spot FX while simultaneously buying a protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in the number of contracts.

Execution: Underlying spot exposure + short 2w (1%) OTM call + long 1m ATM put.

The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures