Amid the prevailing risks for the slowdown in the global economy, the yen is, on the one hand, in demand as a safe-haven, while on the flip side, it is likely to become more and more obvious in the course of the easing efforts of other central banks that the Bank of Japan will hardly be able to further ease its monetary policy in a credible manner.

Conceptually, the BoJ would have to stop buying bonds at the long end, or even sell JGBs, to defend its yield target. But in light of an inflation that remains close to zero that would be a totally inappropriate restrictive signal which would likely increase the appreciation pressure on the yen substantially. The BoJ recently reduced its purchases at the long end slightly, but there was no significant effect on the yield curve. And at the short end, downside potential is limited by the key interest rate. Since the Bank of Japan has included the cost considerations for the financial sector in its monetary policy decisions, a further permanent easing of Japanese monetary policy - to the extent that it is possible at all - is not credible. Instead, the market will always quickly speculate on a possible normalisation of monetary policy as soon as the economic environment brightens even a little - which would then allow the yen to appreciate again.

In relative terms, the BoJ thus threatens to become more restrictive, especially compared to the Fed, which is why we expect the yen to appreciate significantly against the USD. Since the European central bank (ECB) is also in a similar dilemma to the BoJ and its monetary policy arsenal has practically dried up, we expect EURJPY to move broadly sideways in the near-terms while the major downtrend remains intact. ECB is scheduled for their monetary policy next week.

Contemplating all these underlying factors, euro seems to be edgy on increasingly chronic underperformance of the Euro area economy. We could foresee reasonably bearish risks for EURJPY amid such backdrops.

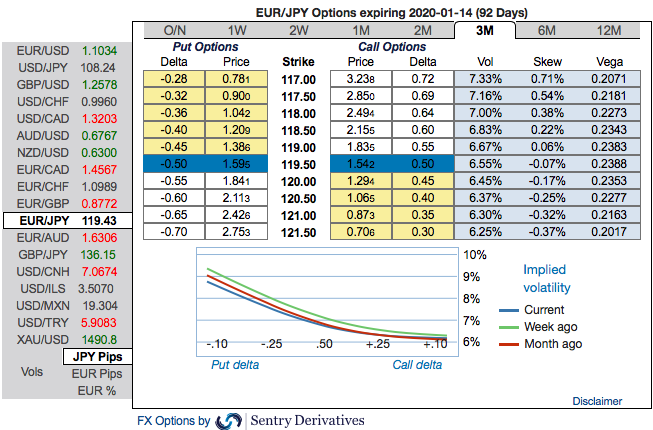

OTC outlook (EURJPY): We noted in our recent post that the positively skewed IVs of 3m tenors signifying the hedging interests for the downside risks. There is no much change in our hedging outlook, as the bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is noteworthy size in the forex options market that can stimulate on the underlying forex spot rate.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for September month deliveries. Source: Sentrix, Saxo & Commerzbank

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data