We kept reiterating that EURJPY has been spiking higher in the minor trend while major trend still remains edgy.

Technically, we’ve already raised red flags about EURJPY bearish risks amid momentary rallies that could be effectivelyt utilized while keeping an eye on below explained OTC indications. For more readings, refer below weblinks:

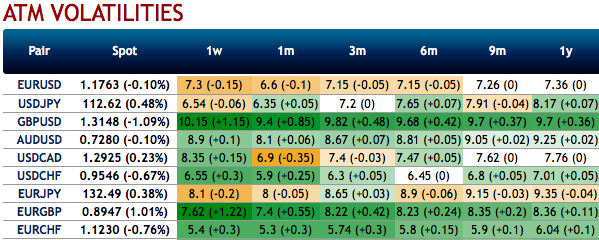

Most importantly, please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 127 levels so that OTM instruments would expire in-the-money.

While negative risk reversal numbers of all euro crosses except EURGBP (especially EURJPY) across all tenors are also substantiating bearish risks in the long run amid minor abrupt upswings in the short-term. IVs for 1m tenors are shrinking away which is good for put option writers, and 3m IVs are rising which is good for put holders.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The Market Pin Risk report shows large options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, EURJPY has the highest interest towards forward point at 130.75). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Options strategies for hedging (EURJPY):

Contemplating above prevailing trend of this pair and OTC indications, we’ve devised various options strategies:

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders. Source: saxobank and sentrix

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 53 levels (which is bullish), while hourly JPY spot index was at -43 (bearish) while articulating at (07:54 GMT). For more details on the index, please refer below weblink:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary