As the total reported death cases exceeds 1.3 million across the world due to the deadly contagious coronavirus, almost all markets have halted with a trauma.

COVID-19 was the factor that triggered the repricing of FX volatilities, after several years spent in a semi-lethargic state, with all-time lows reached just a couple of months back. With the rebound in equity indices and with FX vols taking a leg lower investors are asking about opportunities in the FX vol space for fading elevated risk premia but without taking excessive risk. One such opportunity is binary ranges that importantly have defined downside thus allow fading elevated vol premia while granting attractive risk/reward profiles.

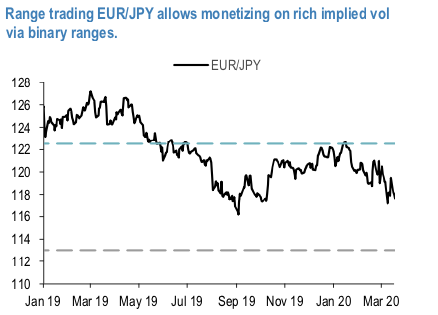

EURJPY tops the list of the liquid pairs that offer ex-ante risk/reward metrics in particular thanks to the sharp rebound in implied vols as spot remained in a tight 5% range over the past 10 months.

Also, while in general binary ranges are long smile convexity, the move in EURJPY and other JPY-crosses butterflies has been more contained than for instance USD pairs, offering an attractive entry point from this angle as well. A 20% TV binary range (i.e., a trade with a maximum leverage of 5:1 if barriers are not touched till expiry) looks attractive.

We choose the strikes slightly asymmetrically in order to grant some margin in case of extended EUR weakness (refer above chart). Hence, we recommend:

Buy 3M EURJPY binary range, barriers at 112/121.5 at EUR 17.9%/20.9% indic (spot reference: 117.30 levels). Courtesy: JPM

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One