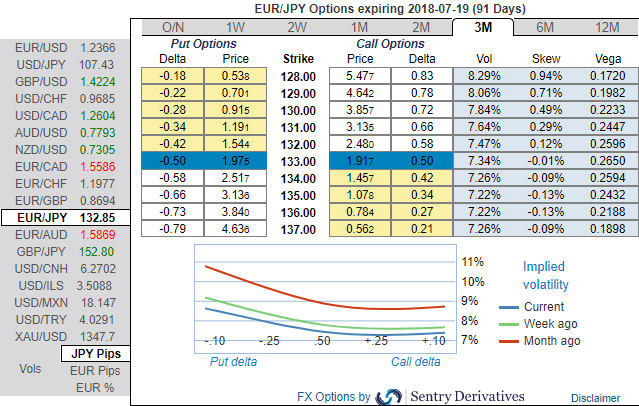

The neutral-negative risk reversal numbers are still indicating hedging sentiments for the potential bearish risks across all tenors remain intact, while positively skewed IVs of the 3m tenors haven’t changed from the last week, signifies the hedgers’ interests in OTM put strikes.

The skews signal underlying spot FX to drop below 128 levels. While glance through above nutshell evidencing risk reversals, although these numbers have been bearish neutral for longer tenor but bearish risk sentiment remain intact on any negative fundamental driving forces, to substantiate this stance we can observe the 2nd highest hedging sentiments for bearish risks of this pair among G10 FX space after USDJPY.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.

Options strategies for hedging:

At spot reference of EURJPY: 132.919 levels, we advocate following strategies on hedging grounds.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 70 levels (which is bullish), while hourly JPY spot index was at -40 (bearish) while articulating at 11:27 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed