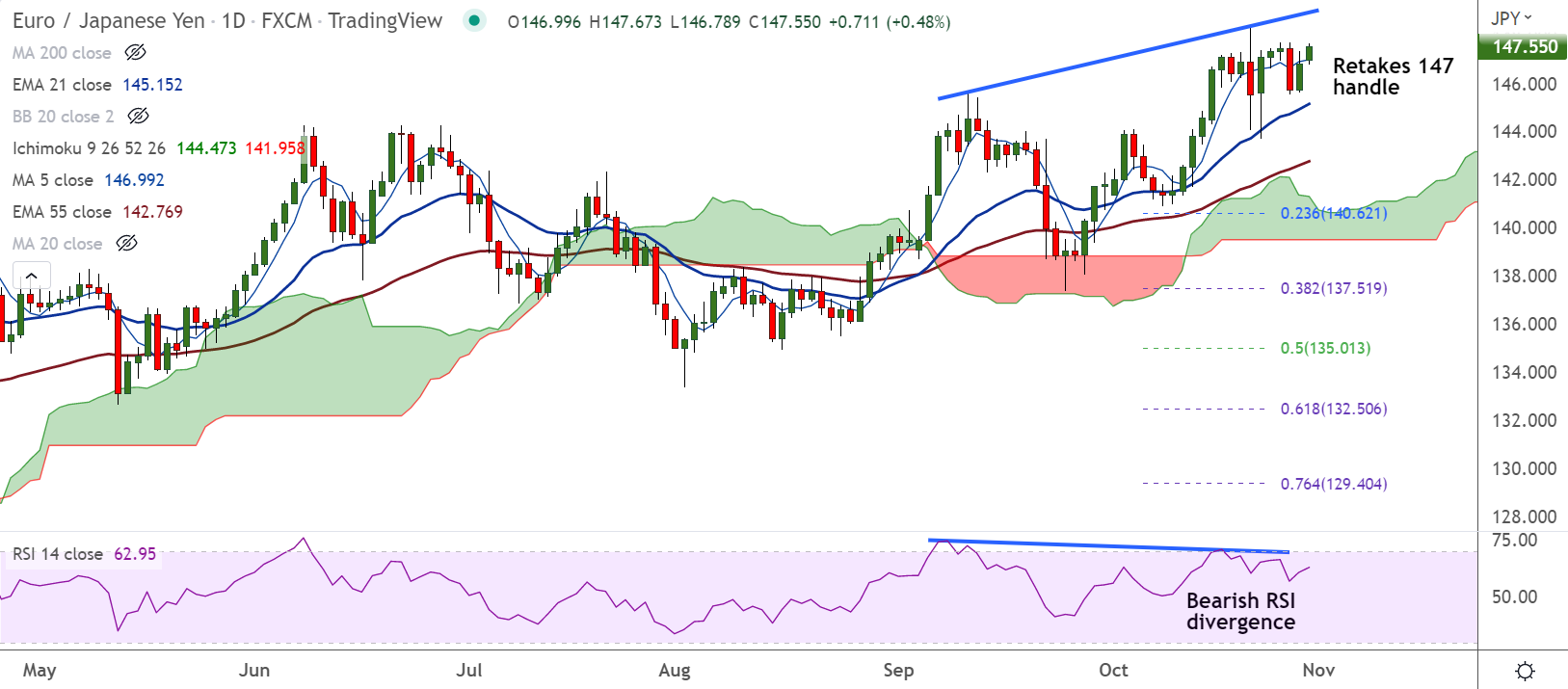

Chart - Courtesy Trading View

EUR/JPY was trading 0.37% higher on the day at 147.39 at around 13:00 GMT, bias bullish.

Data released earlier on Monday showed the Eurozone economy expanded by 0.2% on the quarter in the three months to September of 2022, meeting the 0.2% expected and 0.8% previous.

On an annualized basis, the bloc’s GDP rate printed at 2.1% in Q3 vs. 4.1% booked in the second quarter of 2021 while matching 2.1% expectations.

The latest data published by Eurostat showed that the annualized Eurozone Harmonised Index of Consumer Prices (HICP) accelerate to 10.7% in October from 9.9% in the previous month.

The core figures climbed to 5.0% YoY during the reported month as compared to the 4.9% expected and 4.8% recorded in September.

On the other side, Japan’s Industrial Production fell in September for the first time in four months.

On an annual basis, Industrial Production has climbed to 9.8% in comparison to the consensus of 8.7%.

Further, Japan monthly and annual Retail Trade have accelerated to 1.1% and 4.5% vs. the projections of 0.6% and 4.1% respectively.

Despite solid Japan’s Retail Trade data, the yen remains under pressure amid BOJ’s continuation of a dovish stance.

EUR/JPY trades with a bullish technical bias. The pair is on track to test major trendline resistance at 149 mark. Weakness only below 21-EMA.