Chart - Courtesy Trading View

EUR/JPY was trading 0.05% higher on the day at 139.56 at around 13:50 GMT.

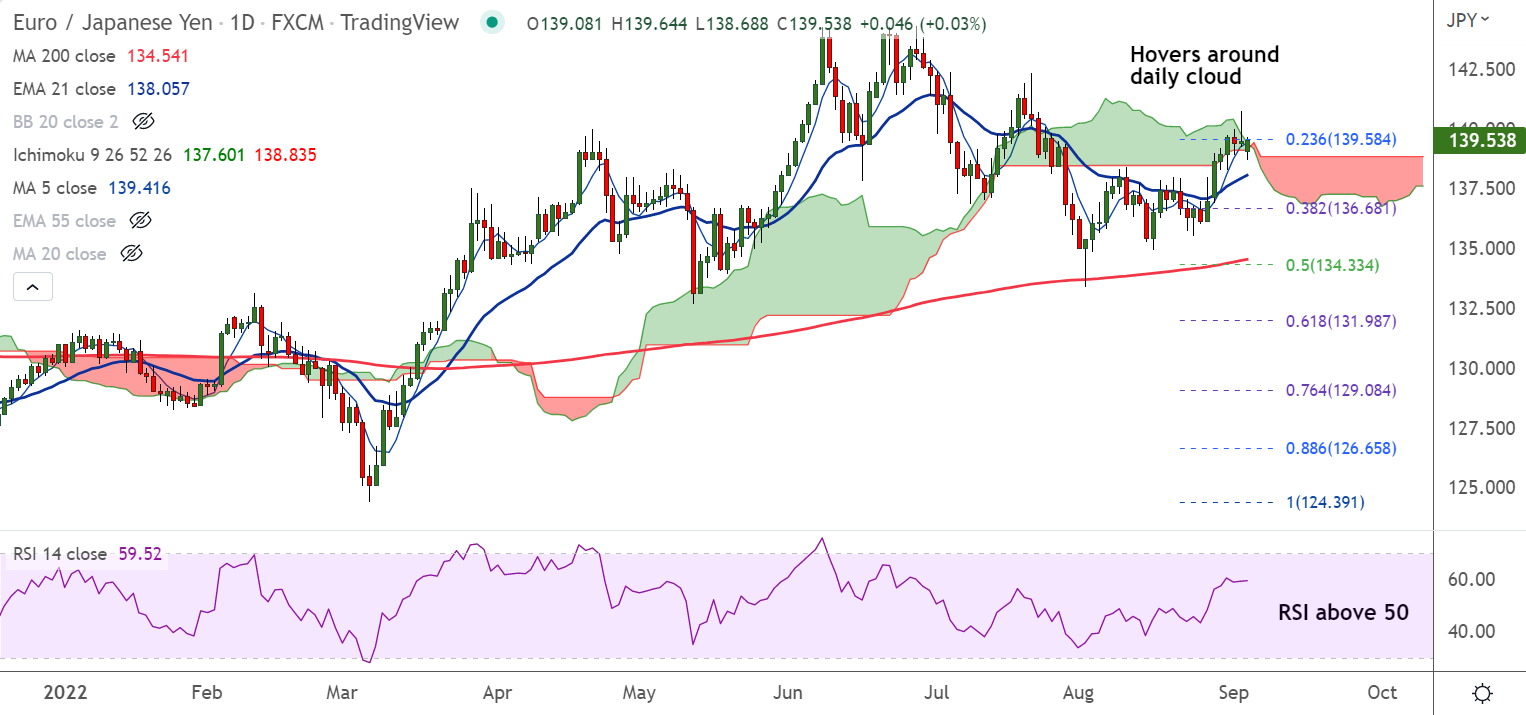

The pair is retracing from daily cloud resistance, break above required for upside continuation.

Inverted hammer formation on the daily charts dents upside in the pair. Price action capped at 23.6% Fib.

The single currency manages to hold gains despite weak EU data released earlier on Monday.

Eurozone Sentix Investor Confidence index came in at -31.8 in September from -25.2 in August vs. -27.5 expected.

The current situation index dropped to -31.8 points in September from -25.2 in August. While the expectations index tumbled to -37.0.

Further, Eurozone’s Retail Sales rose by 0.3% MoM in July missing 0.4% expected and compared to -1.0% in the prior month.

On an annualized basis, the bloc’s Retail Sales came in at -0.9% in July versus -3.2% prior and -0.7% expected.

Support levels - 138.24 (200H MA), 138.07 (55-EMA)

Resistance levels - 140.07 (Upper BB), 140.75 (Previous week high)

Summary: EUR/JPY pivotal at daily cloud resistance. Major trend remains bullish, but break below 200H MA could change near-term trend.