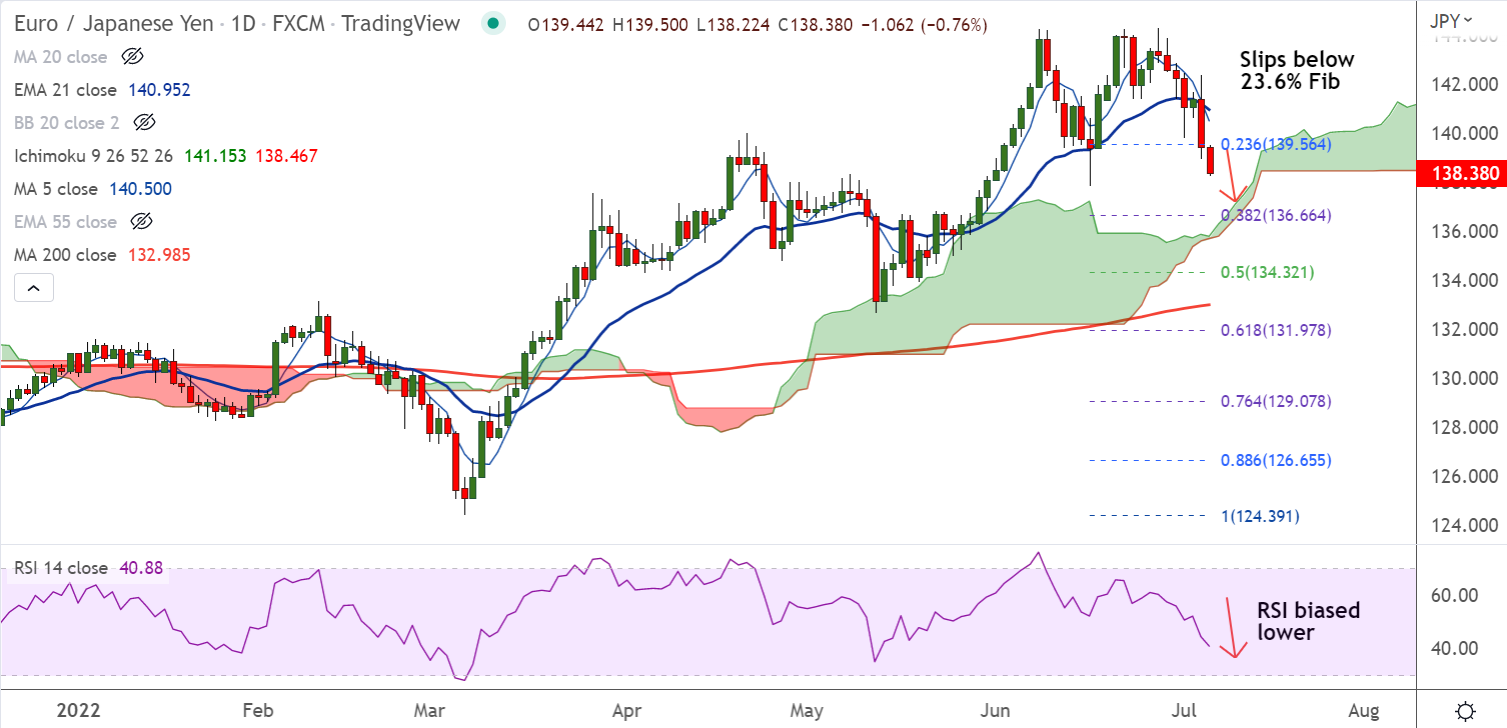

Chart - Courtesy Trading View

EUR/JPY was trading 0.80% lower on the day at 138.32 at around 10:00 GMT. The pair has broken below 50-DMA and 23.6% Fib, further weakness on cards.

Technical Analysis:

- MACD and ADX support downside

- Momentum is bearish and volatility is high

- GMMA indicator shows minor trend has turned bearish

- Price action is below 200H MA, has slipped below 23.6% Fib

Major Support Levels:

S1: 136.66 (38.2% Fib)

S2: 136.56 (110-EMA)

Major Resistance Levels:

R1: 139.02 (55-EMA)

R2: 140.94 (21-EMA)

Summary: EUR/JPY trades with a bearish bias, the pair is on track to test 38.2% Fib at 136.66.