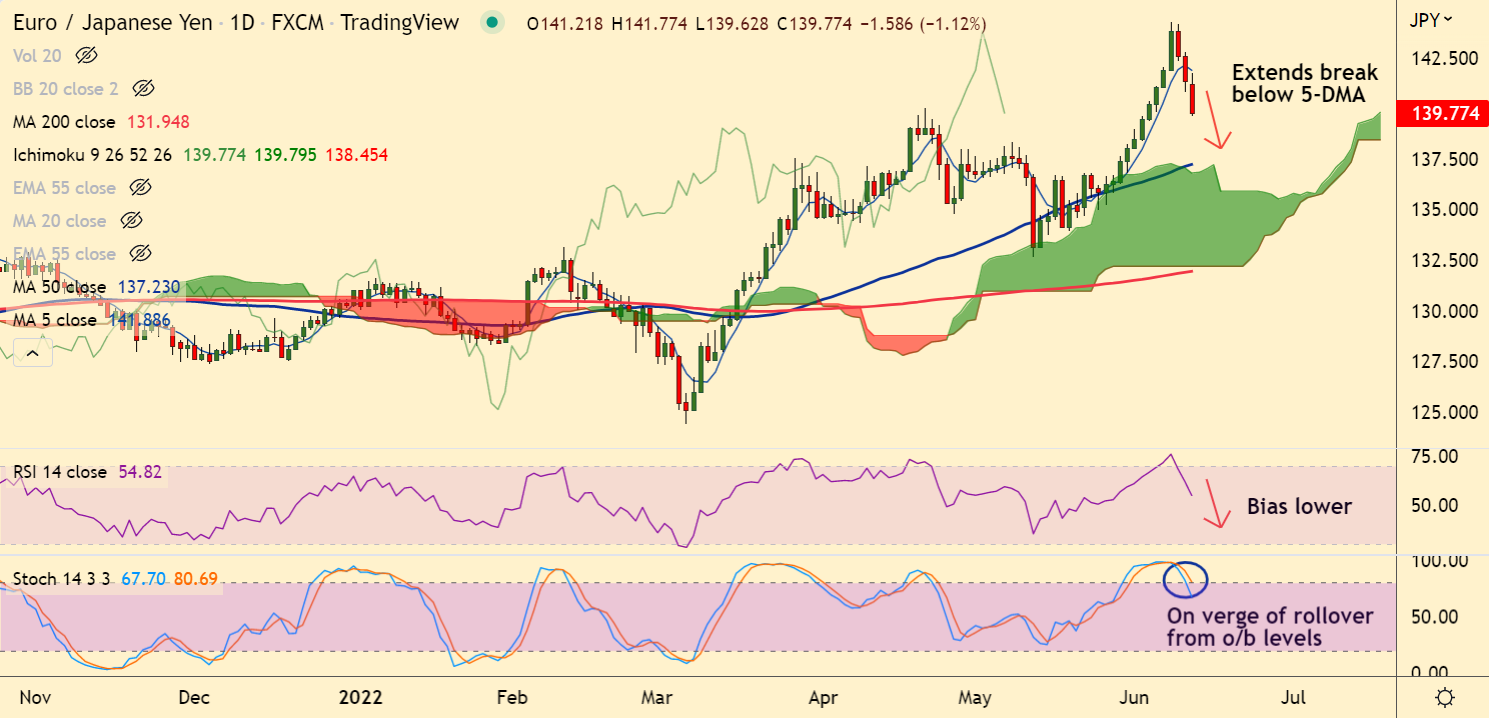

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- EUR/JPY was trading 1.13% lower on the day at 139.75 at around 13:40 GMT

- Recovery attempts in the pair have been capped at 5-DMA which is trending lower

- MACD is on verge of bearish crossover on signal line, Chikou span is biased lower

- Momentum is bearish. RSI confirms bearish rollover from overbought levels

- Price action has slipped below 200H MA and GMMA indicator shows major and minor trend are bearish

Support levels - 139.05 (21-EMA), 138.30 (20-DMA)

Resistance levels - 141.08 (200H MA), 141.86 (5-DMA)

Summary: EUR/JPY trades with a bearish bias. Scope for test of 20-DMA at 138.30.