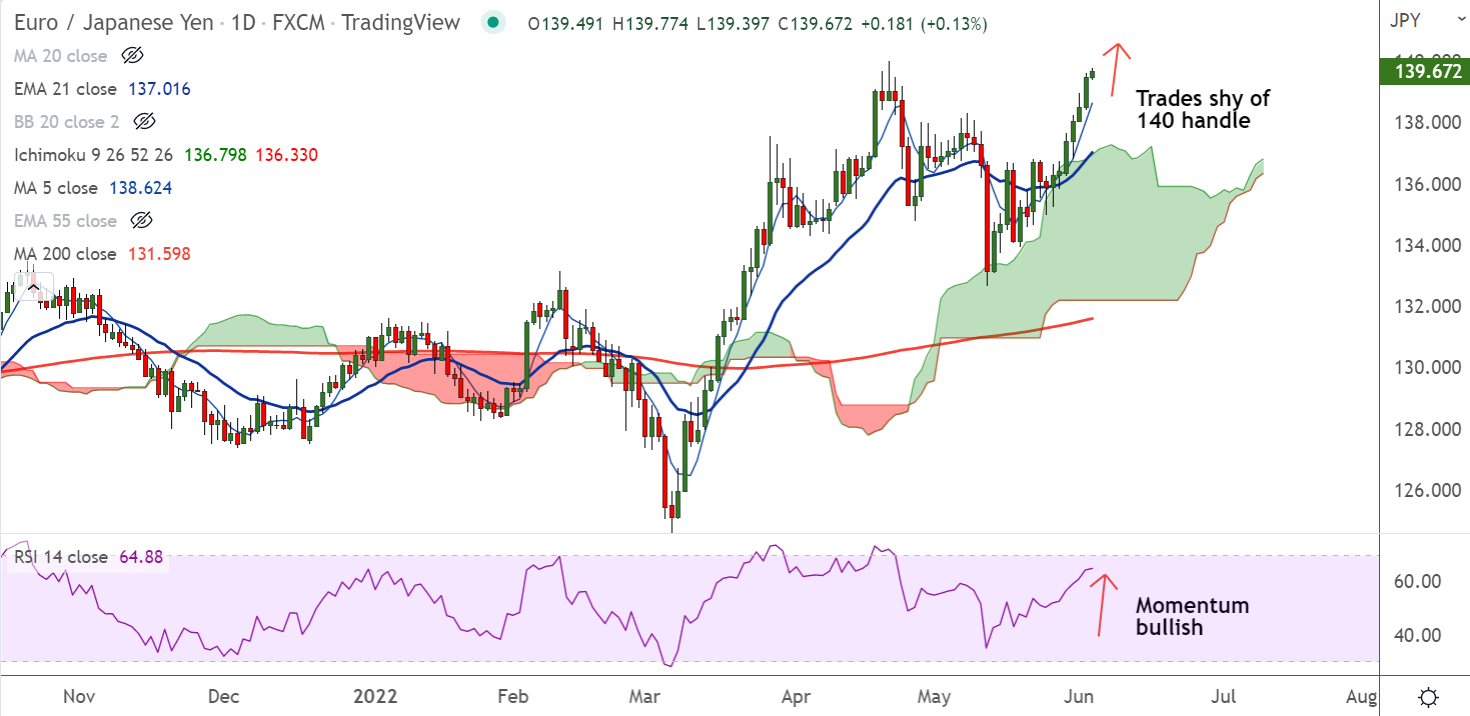

Chart - Courtesy Trading View

EUR/JPY extends bullish streak for the 7th straight session, outlook remains bullish. The pair trades shy of 140 handle, is on track to refresh yearly highs above 140.004 (hit on April 21st).

Technical Analysis:

- GMMA indicator shows major and minor trend are bullish

- Volatility is high, momentum is bullish, Stochs and RSI are biased higher

- Pullback has bounced off daily cloud support, weakness only on break below

- MACD and ADX support gains, Chikou span is biased higher

Support levels:

S1: 138.63 (5-DMA)

S2: 137.19 (200H MA)

Resistance levels:

R1: 140.004 (April 21st high)

R2: 141.055 (June 2015 high)

Summary: EUR/JPY trades with a bullish bias. Scope for refreshing yearly high above 140 handle. Bullish invalidation only below daily cloud.