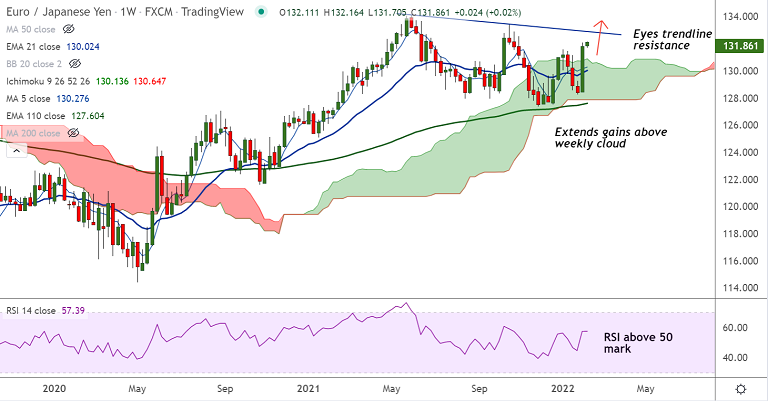

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

- EUR/JPY closed a whopping 2.66% higher in the previous week

- The pair is set to extend previous weeks gains as technicals remain bullish

- Bearish engulfing pattern formed on the daily candle raises scope for more downside

- GMMA indicator shows minor trend is strongly bullish

- Price action is above 200-DMA and is consolidating break above weekly cloud

Fundamental Overview:

Disappointing German macro data undermined the euro, aiding the selling bias in the pair.

German Industrial Production unexpectedly fell by 0.3% in December, missing consensus for a 0.4% rise.

Further, Eurozone’s investor sentiment extended its upbeat momentum in February, the latest data published by the Sentix research group showed on Monday.

The gauge jumped to 16.6 in February from 14.9 in January, beating forecasts for an advance to 15.2.

A current conditions index rose to 19.3 in February from 16.3. While an expectations index rebounded to 14.0 from 13.5, the highest reading since July 2021.

Support levels - 130.66 (5-DMA), 130.45 (200-DMA)

Resistance levels - 131, 132.02 (Upper BB)

Summary: EUR/JPY seeing some profit taking on Monday. Bearish engulfing to drag the pair lower. Major trend is bullish.