Chart - Courtesy Trading View

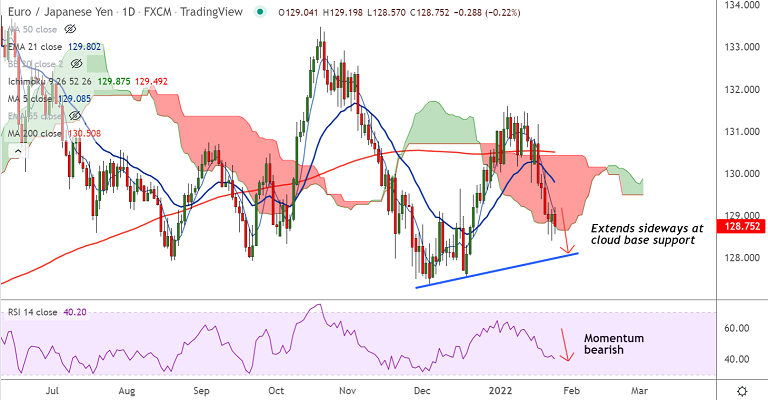

EUR/JPY was trading 0.22% lower on the day at 128.75 at around 10:40 GMT.

The pair is extending sideways at cloud base support, break below will see more downside.

MACD and ADX support downside in the pair. Oscillators are strongly bearish, Stochs and RSI are sharply lower.

Volatility is high and rising and major moving averages on the daily chart are trending lower.

GMMA indicator shows major trend is turning bearish while minor trend is strongly bearish.

Support levels - 128.00 (Rising trendline), 127.45 (110-week EMA), 126.84 (Lower W BB)

Resistance levels - 128.98 (55-week EMA), 129.07 (5-DMA), 129.79 (converged 21 and 55 EMAs)

Summary: EUR/JPY trades with a bearish bias. Watch out for break below daily cloud for further weakness.