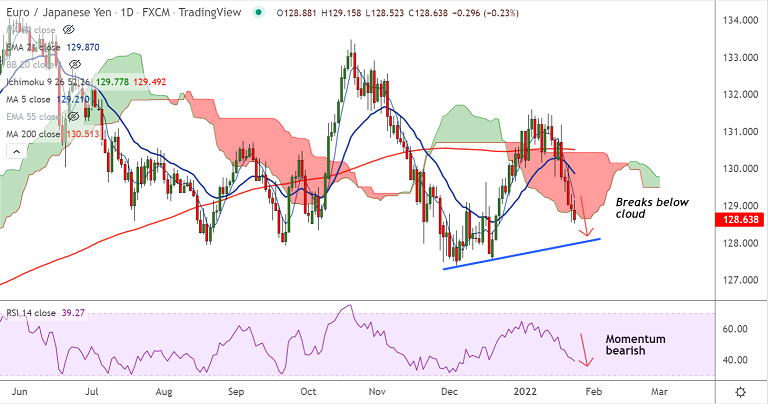

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- EUR/JPY is extending weakness for the 3rd straight week

- Price action slips below the daily cloud

- Momentum studies are bearish, Stochs and RSI are sharply lower

- GMMA indicator shows minor trend is bearish while major trend is turning bearish

- Volatility is high and rising as evidenced by widening Bollinger bands

Support levels - 128.33 (Oct 6 low), 128 (Rising trendline), 127.45 (110-week EMA)

Resistance levels - 128.97 (55-week EMA), 129.20 (5-DMA), 129.82 (55-EMA)

Summary: EUR/JPY was trading with a bearish bias and break below cloud has reinforced downside in the pair. Bears eye 128 (trendline support). Break below to drag prices lower.