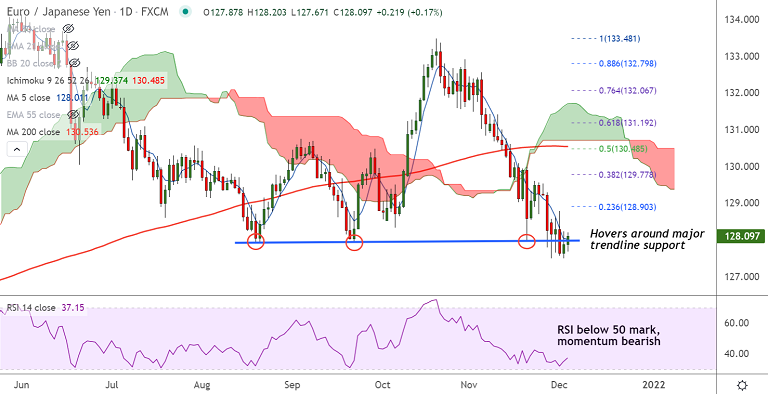

Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.20% higher on the day at 128.12 at around 11:05 GMT

Previous Week's High/ Low: 129.59/ 127.79

Previous Session's High/ Low: 128.22/ 127.49

Fundamental Overview:

The single currency remained depressed after ECB President Christine Lagarde sticks to a dovish narrative.

Lagarde reiterated that they are unlikely to hike the policy rate in 2022. "We stand ready in both directions," she added.

On the data front, Eurozone Retail Sales rose by 0.2% MoM in October versus 0.2% expected and -0.4% last.

On an annualized basis, Retail Sales printed at 1.4% in October versus 2.6% recorded in September and 1.2% estimated.

Technical Analysis:

- EUR/JPY is extending the bearish streak for the 7th consecutive week

- Price action is extending downside inside the weekly cloud and is well below the daily cloud

- MACD and ADX support weakness, volatility is high and rising

- Price action is hovering around major trendline support at 127.93

Major Support and Resistance Levels:

Support - 127.93 (trendline), Resistance - 128.84 (55-week EMA)

Summary: EUR/JPY price action remains capped between 55 and 110 week EMA. Outlook is bearish as long as price remains below trendline at 127.93.