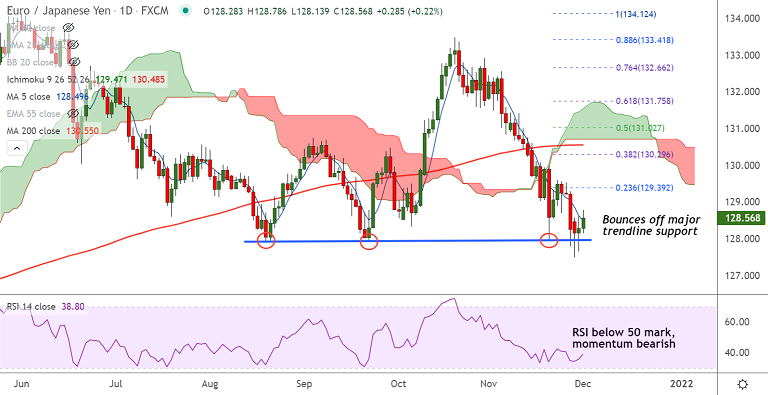

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

GMMA Indicator

- Shows strong bearish bias on near and long term moving averages on daily charts

- Bias on the intraday charts has gone neutral

Ichimoku Analysis

- Price action well below the daily cloud

- The pair is trading within the weekly cloud

Oscillators

- Stochs and RSI are on verge of bullish rollover from oversold levels

- RSI is well below the 50 mark and shows strength in the current downtrend

Bollinger Bands

- Bollinger bands are spread wide apart, but gap is shrinking

- Volatility is high, likely to add fuel to the downside momentum

Major Support Levels: 127.93 (trendline support), 127.15 (110-week EMA)

Major Resistance Levels: 128.78 (200H MA), 128.85 (55-week EMA)

Summary: EUR/JPY has paused downside at major trendline support at 127.93. Decisive break below is required for further weakness.