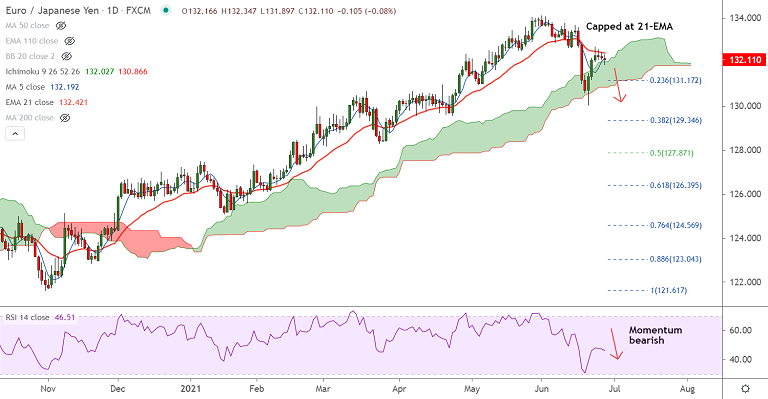

EUR/JPY chart - Trading View

Spot Analysis:

EUR/JPY was trading largely unchanged, extends sideways for the 4th consecutive session.

The pair was 0.06% lower at 132.12 at around 12:10 GMT, with session high at 132.34 and low at 131.89.

Previous Week's High/ Low: 132.69/ 130.04

Technical Analysis:

- Analysis of GMMA indicator shows major and minor trend are neutral

- Price action remains capped between 21 and 55 EMAs

- Pullback from multi-month highs on account of bearish divergence has held support at daily cloud

- Momentum is bearish with RSI below the 50 mark and biased lower

Support levels - 131.91 (55-EMA), 130.95 (Lower BB), 130.48 (110-EMA)

Resistance levels - 132.42 (21-EMA), 132.69 (20-DMA), 133 (Psychological mark)

Summary: EUR/JPY is struggling to extend previous week's gains. Price action remains capped between major EMAs. Breakout will provide clear directional bias.