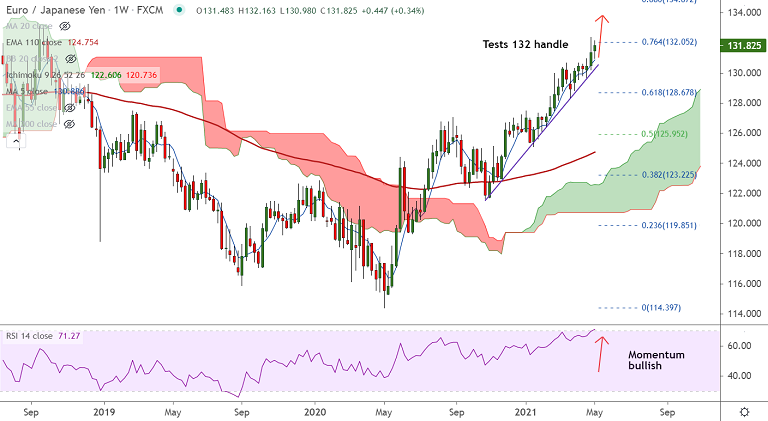

EUR/JPY chart - Trading View

Technical Analysis: Bias Bullish

- GMMA indicator shows major and minor trend are strongly bullish

- Price action is consolidating break above 200-month MA

- Momentum is with the bulls, Stochs and RSI are biased higher

- Volatility is high and rising as evidenced by widening Bollinger bands

- Price action is above daily cloud and major moving averages, Chikou span is biased higher

Support levels - 131.45 (5-DMA), 130.89 (21-EMA), 130.28 (200-month MA)

Resistance levels - 132.05 (76.4% Fib), 132.20 (Upper BB), 133.13 (17th Sept 2018 high)

Summary: EUR/JPY trades with a bullish bias. Price action has tested 76.4% Fib and is consolidating above 200-month MA. Scope for further upside. Gains till 133 mark likely.