EURJPY has seen mild considerable price rallies in this month upon below-mentioned patterns, however, the trend seems to be absolutely edgy but with little weakness for today.

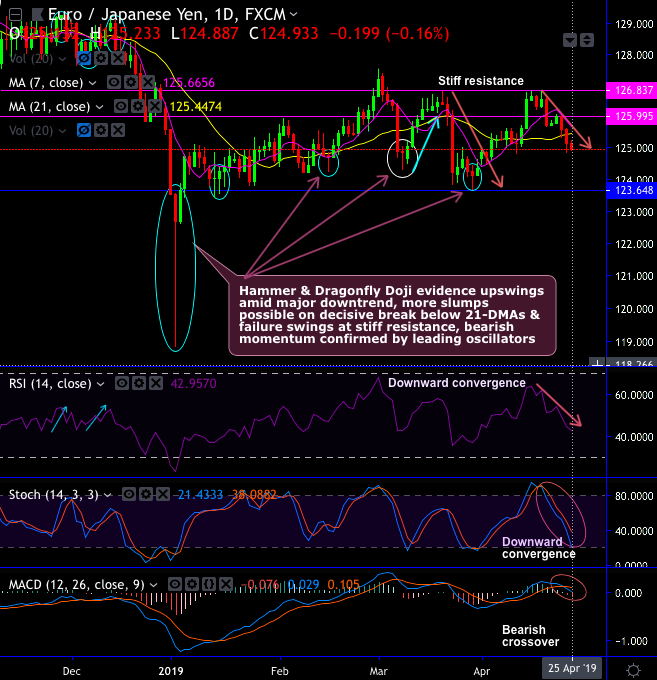

Technical chart and candlestick patterns formed – Hammer pattern candles pop-up at 127.574 and 128.141 levels that evidence upswings, whereas gravestone doji and hanging man patterns counter. The similar patterns have occurred in the recent past as well, consequently, prices have plummeted below DMAs (refer daily chart).

While on intermediate trend also, bearish engulfing evidences price drops below EMAs (refer monthly chart). For now, the current major trend most likely to prolong bearish swings that are backed by both momentum oscillators as both leading indicators (RSI & stochastic curves) show downward convergence that signal bearish strength & momentum and weakness remains intact on the monthly terms.

Trade tips: On trading perspective, at spot reference: 124.916 levels, it is advisable to boundary option spreads, using upper strikes at 125.6641 and lower strikes at 124.247 levels, the strategy is likely to fetch leveraged yields as long as the underlying spot FX remains between these strikes on the expiration.

Alternatively, we advocate shorts in futures contracts of mid-month tenors with a view to arresting potential dips.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -72 levels (which is bearish), while hourly JPY spot index was at 66 (bullish) while articulating at 06:35 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex