Although the bearish swings in the major trend of EURJPY seem to be threatening, you observe range bounded trend has been persisting from last fortnight or so (upper range at 123.507 and lower range at 121.734 levels).

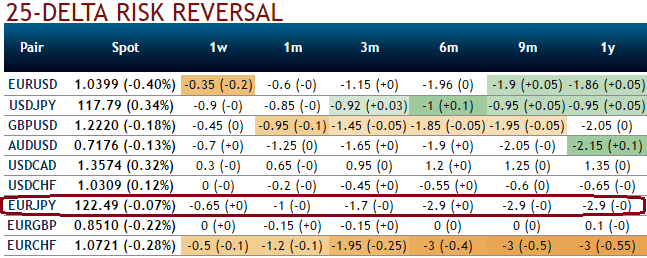

The ATM IVs of this pair is jerking below 7.15% and below 10.5% for 1w and 1m tenors respectively, while negative delta risk reversal numbers are bidding for downside risks.

Fundamentally, it may give EUR some cushion on following fronts:

Economic growth is expected to pick up in Q4, but political risks abound in 2017

Headline inflation is set to accelerate further, but underlying ‘core’ inflation shows no signs as yet of any meaningful rise.

ECB extends asset purchases until end-2017, but at a reduced monthly pace of €60bn from April.

By connecting the dots of fundamental factors, OTC indications with range bounded trend as stated above. The ongoing tight tug of war between bulls and bears in the sideway trend likely to persist. We think this lower IV time is quite conducive for option writers when underlying spot FX is stuck in range.

Hence, on a short run basis, we reckon the long put butterfly spread is best suitable in such scenarios on speculative grounds that carry the limited returns and the limited risk.

Three distinctive strikes are involved in this spread and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option.

The maximum return for the long put butterfly is achievable when the GBPNZD spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

This strategy is typically executed when the options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration and for the cost advantage.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch