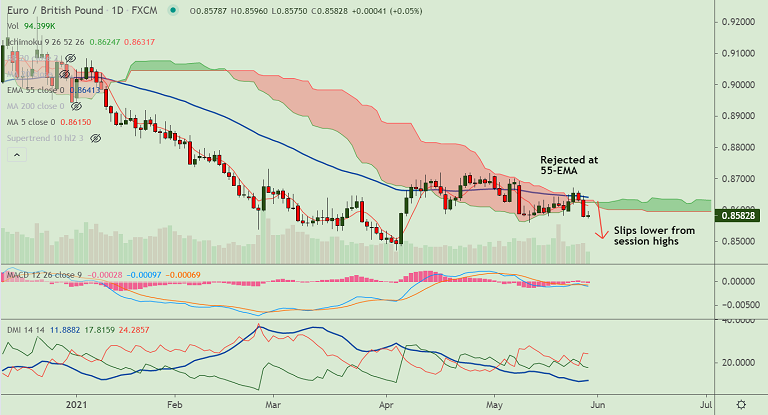

EUR/GBP chart - Trading View

EUR/GBP was trading 0.05% higher on the day at 0.8582 at around 13:20 GMT, outlook remains bearish.

The pair was rejected at 55-EMA and has turned bearish. Potential Gravestone doji on the weekly candle dents upside.

The European Commission’s monthly sentiment survey showed Eurozone economic sentiment improved by more than expected to a three-year high in May.

Data released on Friday showed strongest gains in services, retail and among consumers as governments eased pandemic restrictions.

The European Commission’s economic sentiment index rose to 114.5 points in May from 110.5 in April, beating forecasts at 112.1.

Optimism in services rose to 11.3 points from 2.2, far above expectations of a rise to 7.5. Sentiment in the retail sector rose to 0.4 from -3.0.

Consumer sentiment increased to -5.1 from -8.1 in April, moving well above the long-term average of -11.0.

The index for consumers for price trends over the next 12 months moved up to 22.2 from 19.6, above the long-term average of 18.6. Selling price expectations among manufacturers also jumped to 29.9 in May from 24.2 in April.

Technical indicators are turning bearish. Price action fails to hold above daily cloud. Price action has dipped below 200H MA.

Downside resumption will see test of trendline support at 0.8490 ahead of yearly lows at 0.8471.