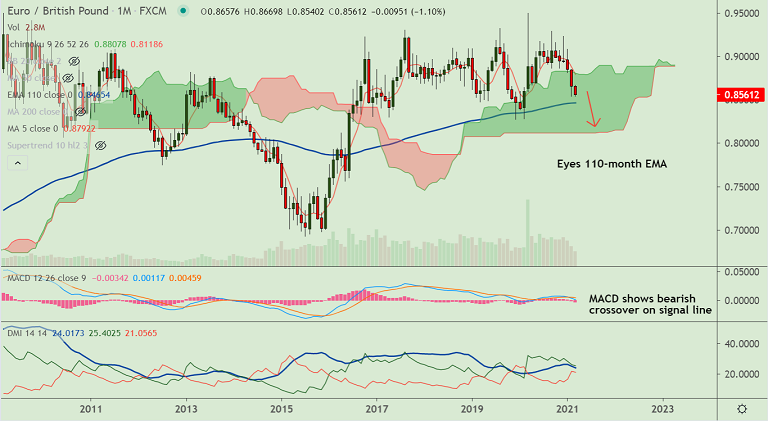

EUR/GBP chart - Trading View

EUR/GBP was trading 0.09% lower on the day at 0.8557 at around 10:50 GMT, outlook bearish.

The pair's uptick on Tuesday was rejected at 21-EMA, the pair closed trade with an inverted hammer formation.

The single currency under pressure after ECB executive board member Isabel Schnabel said late Tuesday that the European Union’s (EU) EUR750 billion ($893 billion) covid recovery fund may prove too small.

Safety concerns that stalled vaccine rollouts in many parts of Europe dent hopes of a faster recovery and weigh on the pair.

Price action has slipped into monthly cloud and is on track to test 110-month EMA at 0.8465.

Major trend is strongly bearish and 21-EMA is a major resistance. Decisive break above could change near-term bias.