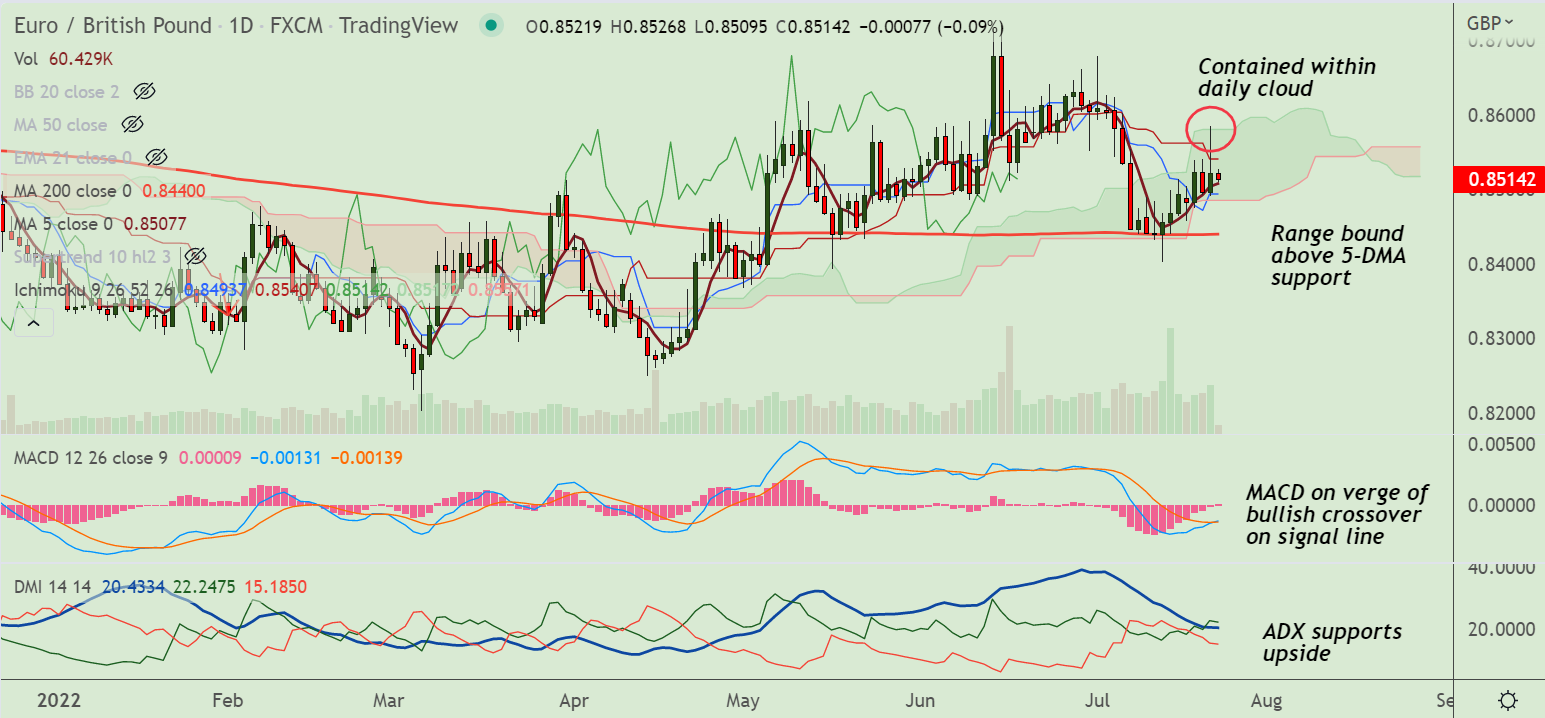

Chart - Courtesy Trading View

EUR/GBP was trading 0.08% lower on the day at 0.8515 at around 05:00 GMT.

The pair hit two-week highs at 0.8584 after the ECB policy decision, but quickly erased most of the gains to close at 0.8521.

The European Central Bank (ECB) on Thursday announced a 50 basis points rate hike, vs. market expectations for a 25 basis points hike.

ECB Lagarde, in her testimony, guided that the ECB is interested in elevating interest rates by 25 bps in July and later on by 50 bps in September.

However, doubts over the European Central Bank’s (ECB) ability to tame regional crisis with rate hikes weighs on the euro.

Focus now on the UK Retail Sales data for impetus. Analysts expect UK Retail Sales may slip to -5.3% vs. -4.7% recorded earlier.

Major Support Levels:

S1: 0.8508 (5-DMA)

S2: 0.8482 (110-EMA)

Major Resistance Levels:

R1: 0.8527 (20-DMA)

R2: 0.8579 (110-EMA)

Summary: Technical indicators for the pair are turning bullish. Price action has bounced off 200-DMA and is juggling within the daily cloud.

Decisive break above cloud will propel the pair higher. On the other side, breach below 200-DMA will invalidate any upside bias.