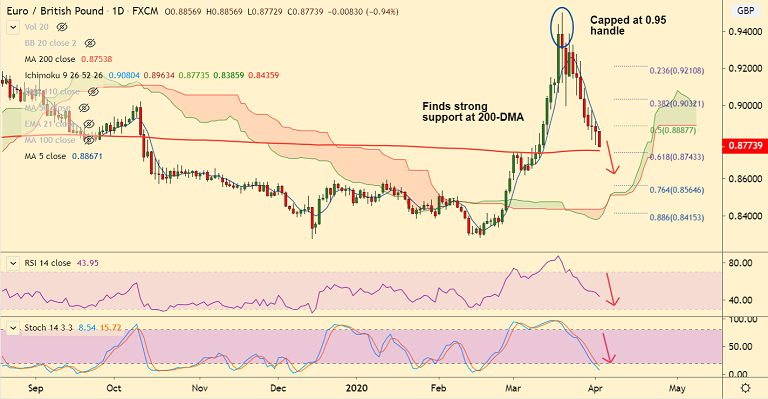

EUR/GBP chart - Trading View

EUR/GBP was trading 0.83% lower on the day at 0.8783 at around 11:00 GMT, extending weakness for the 8th straight session.

The pair has edged higher from session lows at 0.8759, finds strong support at 0.8753 (nearly converged 200-DMA and 55-EMA).

Major trend in the pair is neutral and minor trend is bearish as evidenced by the GMMA indicator.

Momentum studies are bearish. MACD shows bearish crossover on signal line. Bearish 5-DMA crossover on 20-DMA adds to the bearish bias.

The pair remains pivotal at 200-DMA support, break below will open downside. Drag till 76.4% Fib at 0.8564 likely.

5-DMA is immediate resistance capping upside at 0.8868. Retrace above 20-DMA to confirm bearish invalidation.

Support levels - 0.8753 (200-DMA), 0.8695 (110-EMA), 0.8672 (50-DMA)

Resistance levels - 0.8868 (5-DMA), 0.8920 (21-EMA), 0.8994 (20-DMA)

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation