- BoE November rate hike expectations currently supporting sterling. Currently, the market is around 80% priced for a 25bps rate hike on November 2.

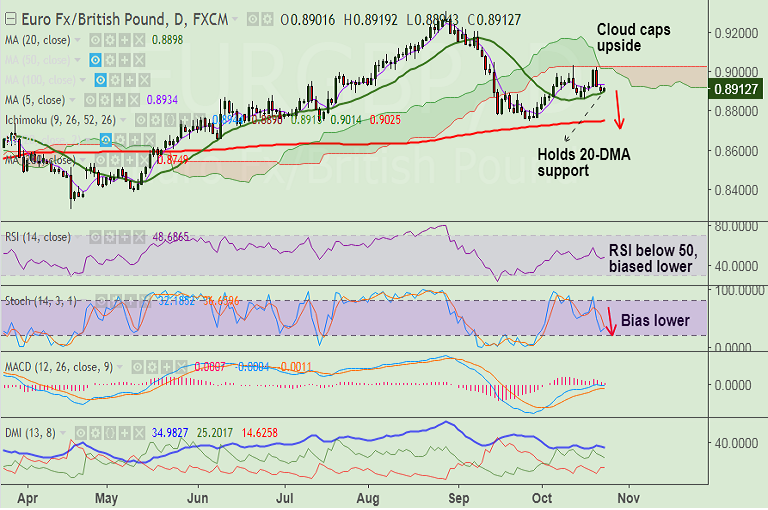

- EUR/GBP slipped below 5-DMA after rejection at daily cloud, bias slightly bearish.

- Technical studies have turned slightly bearish, RSI has fallen below 50 levels and Stochs are biased lower.

- The pair has managed to find some support near 20-DMA at 0.8892.

- Break below will accentuate weakness. Scope then for test of 200-DMA at 0.8748.

- On the flipside, we see upside only on break above daily cloud at 0.9025.

- Further, UK GDP data due Wednesday will be in focus for further impetus in the pair.

Support levels - 0.8899 (20-DMA), 0.8855 (Oct 16 low), 0.88, 0.8746 (Sept 27 low)

Resistance levels - 0.8935 (nearly converged 100&5-DMA), 0.8994 (50-DMA), 0.9014 (cloud base)

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 52.7456 (Neutral), while Hourly GBP Spot Index was at 152.881 (Bullish) at 0940 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest