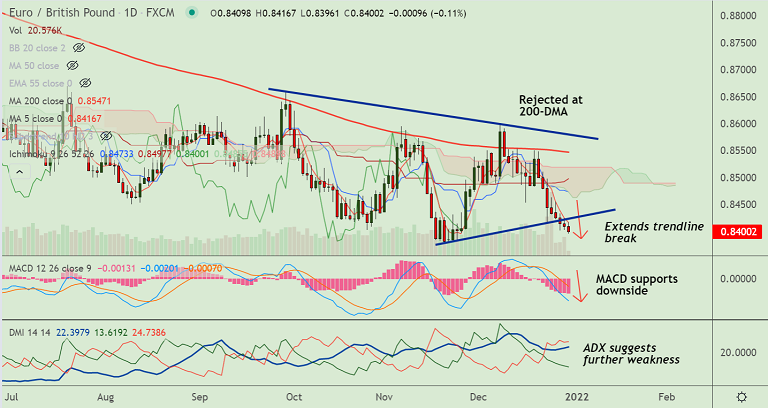

Chart - Courtesy Trading View

EUR/GBP was trading 0.14% lower on the day at 0.8398 at around 08:25 GMT. The pair is extending bearish streak for the 8th straight session, further weakness on cards. The single currency under pressure after dovish ECB comments.

The European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview earlier on Thursday that the central bank maintain very favorable financing conditions for economy. Visco said that the central bank is unlikely to end tapering before 2023.

Technical Analysis for EUR/GBP: Bias Bearish

GMMA Indicator

- Major and minor trend are strongly bearish

Ichimoku Analysis

- Price action is well below the daily cloud

- Recovery attempts failed to extend cloud breakout

Oscillators

- Stochs and RSI show momentum is strongly bearish

- RSI is well below 50 mark with more room to run

- Stochs are at oversold levels, but no signs of reversal seen

Bollinger Bands

- Wide spread Bollinger bands suggest volatility is high

Major Support Levels: 0.8390 (Trendline), 0.8174 (200-month MA)

Major Resistance Levels: 0.8417 (5-DMA), 0.8465 (21-EMA)

Summary: EUR/GBP is poised for further downside. Strong support is seen at 0.8390, break below will plummet prices.