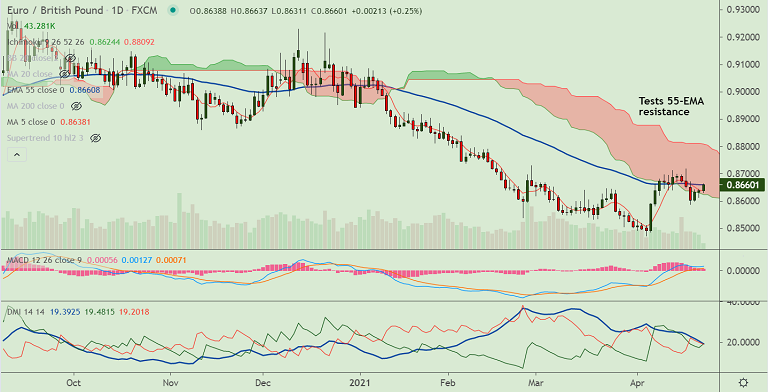

EUR/GBP chart - Trading View

EUR/GBP was extending gains for the 3rd straight session, trades 0.17% higher at 0.8653 at around 08:40 GMT.

The pair has pierced into daily cloud and momentum indicators are biased higher in support of further upside.

Markets await ECB's rate decision. The central bank is widely expected to leave its policy unchanged.

A hawkish tilt from the ECB could boost the euro and support the pair higher. Markets pin hopes on growth prospects in Europe underpinned by the firmer pace of the vaccine rollout.

On the data front, the European Commission will publish its preliminary gauge of the Consumer Confidence for the current month.

The pair is currently testing 55-EMA resistance at 0.8660, decisive break above will fuel further gains. Next bull target lies at 110-EMA at 0.8748.