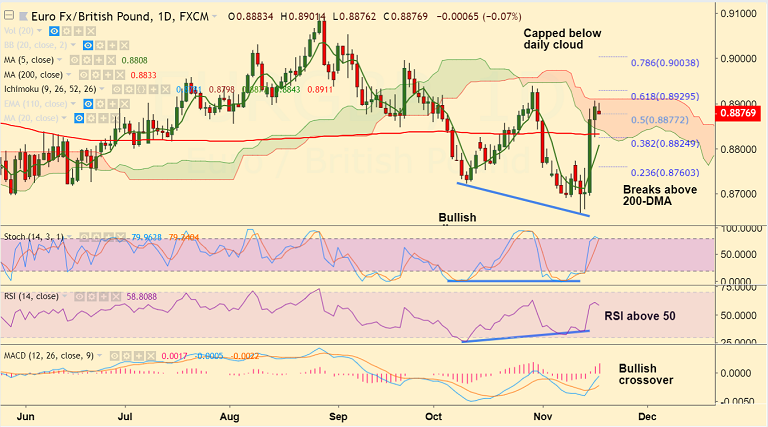

EUR/GBP chart on Trading View used for analysis

- EUR/GBP struggles at daily cloud top resistance, break above to see further upside.

- The pair has been rejected at session highs, trades 0.13% lower on the day at 0.8882 at the time of writing.

- Momentum studies are bullish. RSI is above 50 and MACD is showing a bullish crossover on signal line.

- We also evidence a bullish divergence on RSI and Stochs which raises scope for further gains.

- Break above cloud targets 61.8% Fib at 0.8929 ahead of 0.8939 (Oct 30 high) and 0.90 (78.6% Fib).

- On the flip side, retrace below 200-DMA negates bullish bias.

Support levels - 0.8877 (50% Fib), 0.8833 (200-DMA), 0.8808 (5-DMA)

Resistance levels - 0.8929 (61.8% Fib), 0.8939 (Oct 30 high) and 0.90 (78.6% Fib)

Recommendation: Stay long on break above daily cloud, SL: 0.8870, TP: 0.8930/ 0.90

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts