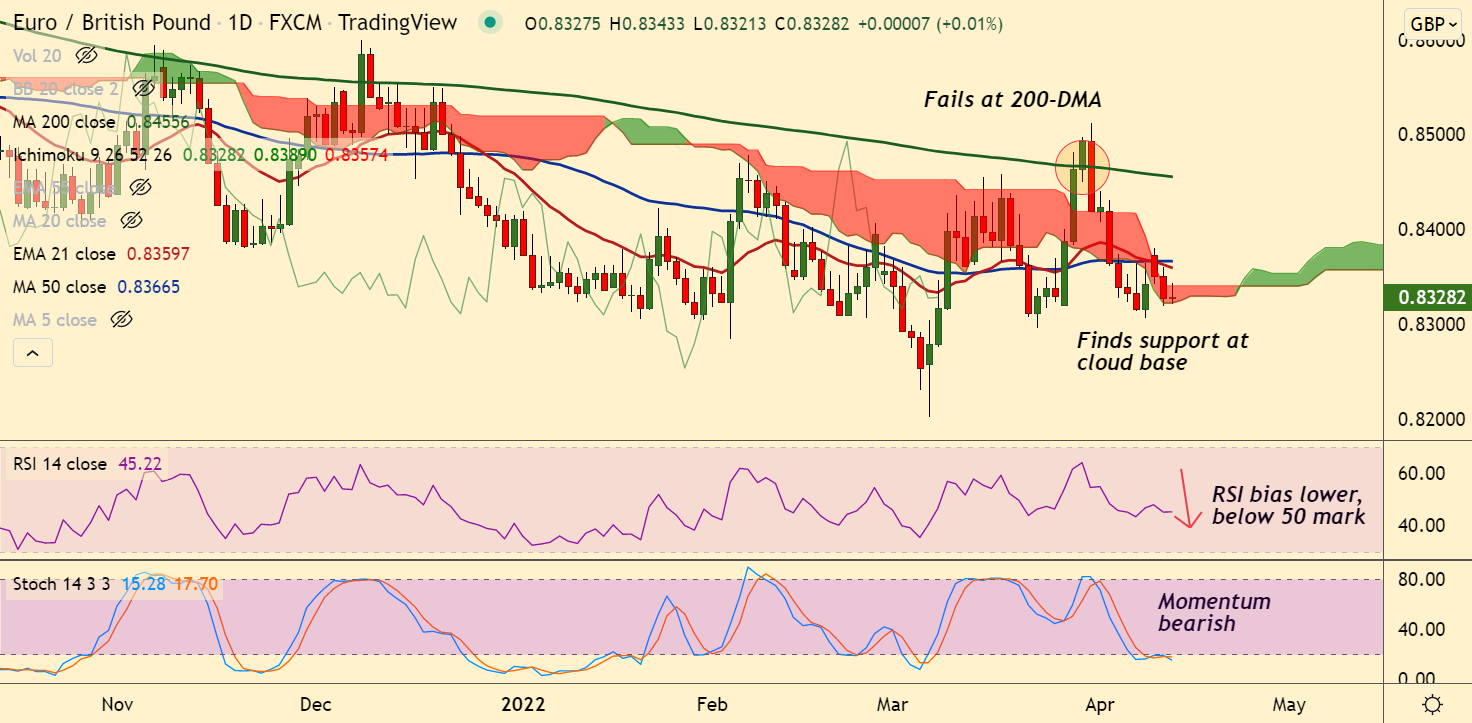

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- EUR/GBP was trading 0.04% lower on the day at 0.8322 at around 12:40 GMT

- The pair has erased early gains and has slipped lower from session highs at 0.8343

- Momentum is bearish. Stochs and RSI are biased lower, RSI is below the 50 mark

- Cloud base is offering strong support, break below will drag the pair lower

- GMMA shows minor trend is bearish, MACD and ADX support weakness

Support levels - 0.8322 (Cloud base), 0.8295 (Mar 23 low), 0.8205 (200-month MA)

Resistance levels - 0.8359 (21-EMA), 0.8389 (21-week EMA), 0.8468 (110-month EMA)

Summary: EUR/GBP trades with a bearish bias. The pair is holding support at daily cloud, breach below will plummet prices.