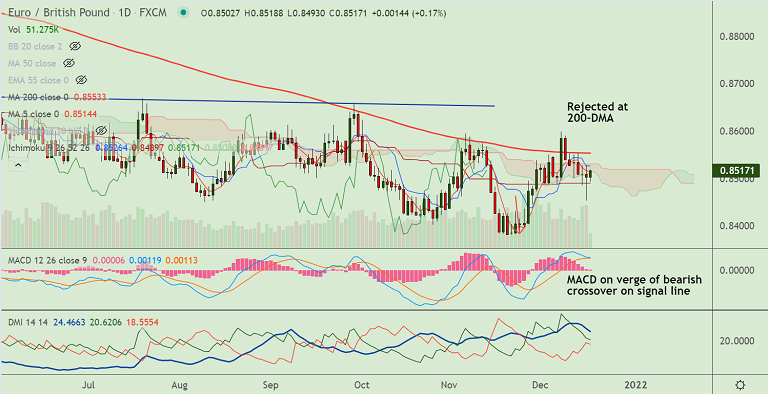

Chart - Courtesy Trading View

Spot Analysis:

EUR/GBP was trading 0.14% higher on the day at 0.8514 at around 10:15 GMT

Previous Week's High/ Low: 0.8599/ 0.8488

Previous Session's High/ Low: 0.8528/ 0.8453

Fundamental Overview:

Data released earlier today showed headline German IFO Business Climate Index fell further to 94.7 in December versus 96.6 in the prior month and missing estimates of 95.3.

Meanwhile, the Current Economic Assessment came in at 96.9 points as compared to last month's 99.0 and 97.5 expected.

The IFO Expectations Index fell to 92.6 in December from the previous month’s 94.2 reading and worse than the market expectations of 93.5.

UK Retail Sales beat estimates with 1.4% MoM in November vs. 0.8% expected and 1.1% previous.

The core retail sales, stripping the auto motor fuel sales, stood at 1.1% MoM vs 0.8% expected and 2.0% previous.

On an annualized basis, the UK retail sales jumped by 4.7% in November versus 4.2% expected and -1.5% prior while the core retail sales rose by 2.7% versus 2.4% expectations and -2.1% previous.

Technical Analysis:

- EUR/GBP is extending weakness after rejection at 200-DMA

- The pair is on a downtrend for the second consecutive week

- Price action is below daily cloud and MACD is on verge of bearish crossover on signal line

- Upside was capped at 50-week SMA, GMMA shows major trend has gone neutral

Major Support and Resistance Levels:

Support - 0.8492 (20-DMA), Resistance - 0.8522 (110-EMA)

Summary: EUR/GBP trades with a neutral bias. Price action trapped between major moving averages. Watch out for break above for further directional bias.