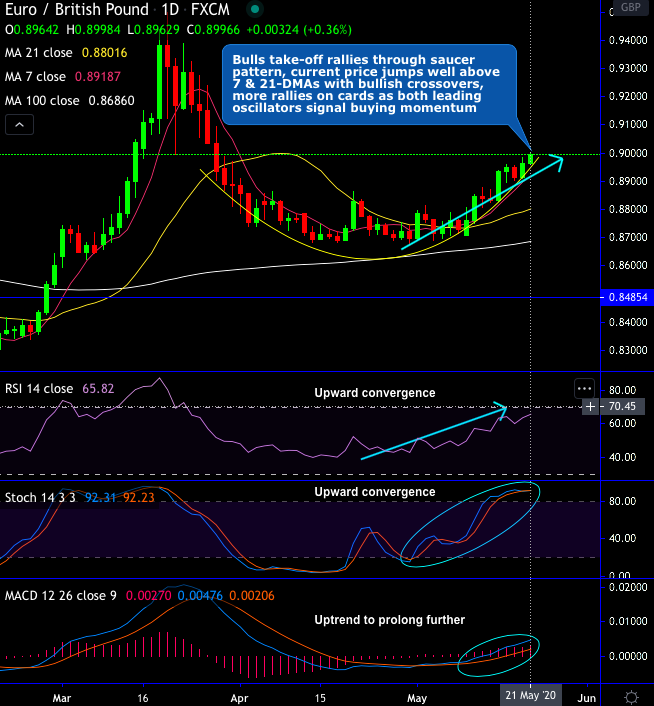

EURGBP minor uptrend has continued above 7, 21 & 100-DMAs, bulls take-off rallies through saucer pattern which is bullish in nature (refer daily chart).

The current price jumps well above 7 & 21-DMAs with bullish DMA & MACD crossovers.

For now, more rallies seem to be on the cards as both leading oscillators (RSI & Stochastic curves) show the upward convergence to the prevailing upswings to signal buying momentum.

On a broader perspective, hammer (at 0.8469 levels) takes-off rallies decisively above EMAs also, bulls in major trend prolong range-bounded trend, both leading & lagging oscillators are quite indecisive.

Prior to which bulls attempted to breakout prolonged range-bounded trend on this timeframe but gave up 11-years highs. In this bullish journey, the pair has recovered its gains in just 2-months (i.e. the rallies that were wiped off from the last 6-months).

The prevailing prices have settled in the lower range between the 0.9500 highs around 0.9200 lows. A decline through 0.8975-0.8930 is needed to suggest a deeper setback towards 0.8750–0.8600 is developing.

Overall, we are monitoring current price action to determine whether the move to 0.9500 was a false break of the medium-term range highs, or whether we test above 0.9802 level.

Trade tips: On trading perspective, at spot reference: 0.8996 levels, contemplating above explained technical rationale, it is advisable to trade one-touch call option strategy using upper strikes at 0.9050 levels, the strategy is likely to fetch leveraged yields as the underlying spot FX keeps spiking further towards upper strikes on the expiration.

Alternatively, long hedges via EURGBP CME futures of June deliveries are activated with an objective of arresting foreseeable upside risks.