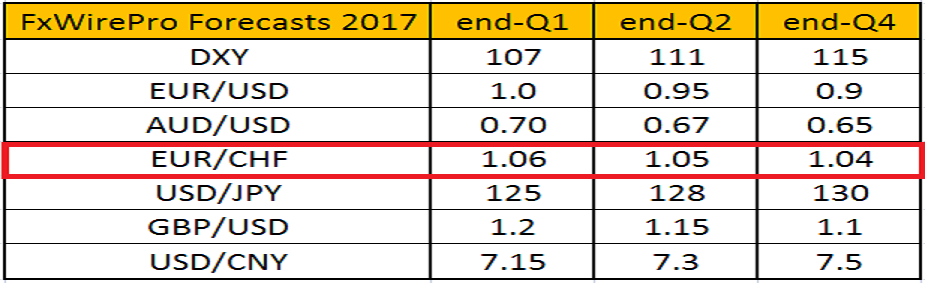

The EUR/CHF currency pair is expected to depreciate by the end of the fourth quarter of 2017, following likelihood of uncertain political developments in the eurozone. An anticipated risk aversion will likely pressurize the EUR in the medium term. The Swiss franc will be guided overall by the path of risk aversion, depreciating against a strengthening greenback.

We foresee that EUR/CHF will touch 1.04 by the end of December 2017; USD/CHF, though, would broadly tend to rise with the USD's ascent. The CHF will remain fundamentally overvalued, tracking the overall path of the Swiss National Bank (SNB).

The likelihood of some destabilizing European political developments during 2017 are likely to see phases of risk aversion that put downward pressure on EUR/CHF. Further, the SNB will manage to contain the currency without cutting interest rates.

Meanwhile, the EUR/CHF traded at 1.07, up 0.14 percent, while at 9:00GMT, the FxWirePro's Hourly Swiss Franc Strength Index remained slightly bearish at -83.86 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings