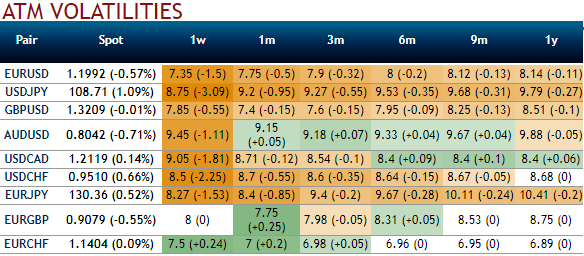

Before we begin with this write-up, please have a glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite this week’s SNB’s monetary policy announcement which is significant. These lower volatile conditions are conducive for the option writers.

Please also be noted that the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but bearish neutral risk reversals indicate that this pair to have been hedged for the downside risks as it indicates puts have been relatively costlier.

On a broader perspective, technically we’ve already stated that the upswings have constantly been hindered at the stiff resistance at 1.1455 levels, while MACD remaining in bullish territory indicates bears swings to prolong further, while RSI and stochastic signal fading strength in rallies on both daily and the monthly terms.

Overall, the non-directional trend likely to persist in major trend but with little weakness is on cards.

But on the contrary, the persistent euro strength should nudge EURCHF higher but significantly. As a result, chances of calls being priced exorbitantly. 2w IV skews have been well balanced on both OTM call and put strikes.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Naked Strangle Shorting:

Short 2m OTM put (2% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (2% strike referring upper cap) (we reiterate, comparatively short term for maturity is desired).

Overview: Slightly bearish in short term but sideways in medium term.

Time frame: 3 months

When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, writing such calls seems smart choice in tepid IVs on speculative or trading grounds.

Considering above OTC market reasoning, amid prevailing uptrend we think downside risks can also not to be disregarded in the long term, as result we reckon deploying shorts in such exorbitant call options.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -39 levels (bearish), while hourly CHF spot index was at shy above -38 (bearish) at 12:37 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges