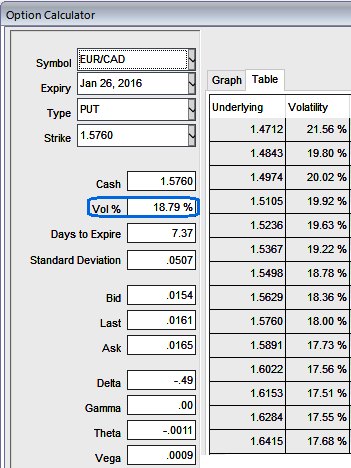

This week's monetary policy decision from central banks of euro area and Canada is most likely to bring in more volatility (see diagram for ATM IVs of 18.79%).

This Thursday ECB President Draghi faces a tough task curbing the appeal of the single currency. The euro jump in recent trend is major due to the massive price drops in crude prices to $28 way below the ECB projections for 2016 ($52.2) and the causing drop in inflation prospects present a stern encounter to the divided governing council opinions.

On the flip side, 25 bps cut is not completely factored in from CAD side, With an approximate 60% probability to this effect, swings in Canada/US rate differentials could be key to USD/CAD testing 1.50 or retracing below 1.40 and EUR/CAD to 1.5425 levels.

Technically, we foresee more downside potential in EURCAD as bearish signals from leading oscillators (RSI & Slow Stoch pops up overbought pressures) and "bearish gartley" formed on weekly charts, so the bulls seem to be exhausted at 1.5959 levels and claiming price dips from last two days, more slumps further are on cards. Hence, the next immediate targets southwards seen at 1.5425 levels.

Hold 2W At-The-Money 0.51 delta call and simultaneously hold 2 lots of 1M At-The-Money -0.48 delta put options. Huge profits achievable with the strip strategy when EURCAD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. The profitability can be maximized for every shift towards downside and this is not the same on upside.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: EUR/CAD seems to be edgy, deploy option strips for hedging and speculating

Tuesday, January 19, 2016 9:13 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary