Bearish EURCAD scenarios:

1) A loss of confidence in Italian fiscal policy that pushes BTP spreads to 400bp and undermines banks,

2) Euro area growth gets stuck below 2% and ECB hikes only in 2020

3) BoC signals a more aggressive path of rate hikes;

4) USMCA ratified early

Bullish EURCAD scenarios:

1) Euro area growth rebounds to 2.5-by end-2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens its calendar guidance for hikes

3) Legislative hurdles arise in USMCA ratification process;

4) Canadian growth slowdown extends vis-à-vis US;

5) Local oil prices weaken further

EURCAD has slid from the peaks of 1.6153 to the current 1.5033 levels in last couple of months. Further material downside from the current levels will likely only come on a gradual basis as USMCA ratification steps are achieved and as Canadian cyclical upside from the “peace dividend” becomes gradually apparent justifying a more BoC hikes than currently priced. BoC monetary policy is also scheduled for this month (precisely on 24thOctober), rate hikes more imminent. While ECB’s monetary policy is scheduled on this Thursday, we continue to believe that delivery of early stage ECB tightening should be more impactful for FX than an extension of late-cycle Fed hikes as the market is liable to become more concerned about the longevity of the US cycle if the Fed is confronted with rather more inflation and less growth than this year.

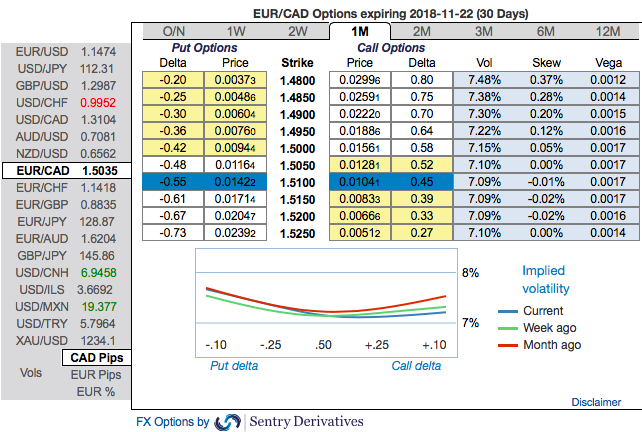

EURCAD OTC outlook: Implied volatilities of this pair have been on the lower side, well below 7.5% across all tenors.

Please be noted that the 1m IV skews have been balanced on either side, but signify more hedgers’ interests on OTM put strikes. Amid this bearish sentiment with lower IVs are interpreted as conducive environment for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

Options Strategy: Contemplating above driving forces and OTC indications, we advocate initiating longs in 1M EURCAD at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 2w (1%) out of the money calls. Thereby, we favor slightly on downside risks as short leg likely to reduce long legs.

Currency Strength Index:FxWirePro's hourly EUR spot index is flashing at 28 (which is mildly bullish), while hourly CAD spot index was at -108 (bearish) at 10:43 GMT. For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis