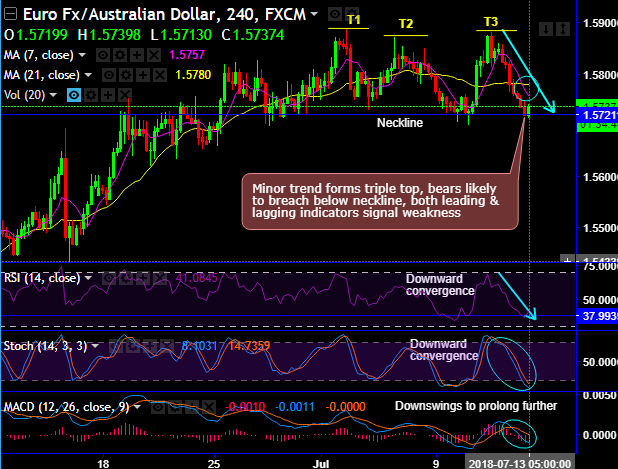

EURAUD minor trend forms the triple top pattern which is bearish in nature, top 1 at 1.5887, top 2 at 1.5870, top 3 at 1.5812 and neckline at 1.5721 levels.

For now, bears likely to breach below the neckline, both leading & lagging indicators signal weakness. Both RSI and stochastic curves show constant downward convergence to the price dips. Current price remains well below DMAs despite today’s rallies.

Bearish SMA and MACD crossovers also substantiate bearish stances, thus, downswings are likely to prolong further.

While on a broader perspective, the Hanging man pops up at peaks of rallies (at 1.6036 levels ) coupled with the overbought signal by leading oscillators, while long-lasting range-bounded major trend persists (refer monthly plotting).

Although there is bullish rallies are observed for today, the overbought pressure is seen, it alarms bears trying to take over the rallies as the slow stochastic noises with %D line cross over.

Hence, on a trading perspective, debit put spreads are advocated as the selling indications are piling up on both daily and monthly graph. So selling an Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing a long position in buying In-The-Money Puts.

So, buy 1w (1%) In-The–Money -0.69 delta put option and short 1w (-1%) Out-Of-The-Money put option for the net debit.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -15 (which is mildly bearish), while AUD is flashing at -31 (bearish), while articulating at 07:50 GMT.

For more details on the index, please refer below weblink: